Got $10,000? 3 Beaten-Down Growth Stocks to Buy in 2022

April 5, 2022

Growth investors have had a tough time so far in 2022, with rising interest rates, higher inflation and a broadly risk-off attitude from the market hurting returns.

There’s also the fact that growth stocks had an incredible 2020 on the back of many “pandemic winners”, from e-commerce players to online payments providers and cloud computing specialists.

As a result, both value stocks and dividend stocks have been back in favour. Yet that doesn’t mean long-term investors should ignore growth stocks.

That’s because, as Warren Buffett famously remarked, investors should “Be fearful when others are greedy and be greedy when others are fearful”.

Clearly, many investors are fearful of being invested in growth stocks. But there are still a lot of quality growth stocks out there.

With that, here are three beaten-down growth stocks that investors can buy with $10,000.

1. PayPal

Online payments giant and ecosystem PayPal Holdings Inc (NASDAQ: PYPL) has had a horrid year so far.

With shares down over 35% in 2022 alone and having declined over 50% in the past 12 months, PayPal’s stock has been hit hard by both the rotation out of growth stocks and issues specific to the company.

However, nothing much has changed with PayPal’s core business of payments. In its latest fourth-quarter 2021 earnings, PayPal saw total payment volume (TPV) hit a record high of US$340 billion – up 28% year-on-year on an FX-neutral basis.

For the whole of 2021, PayPal saw its TPV hit a whopping US$1.25 trillion. Meanwhile, its free cash flow was just shy of US$1.6 billion in the most recent quarter.

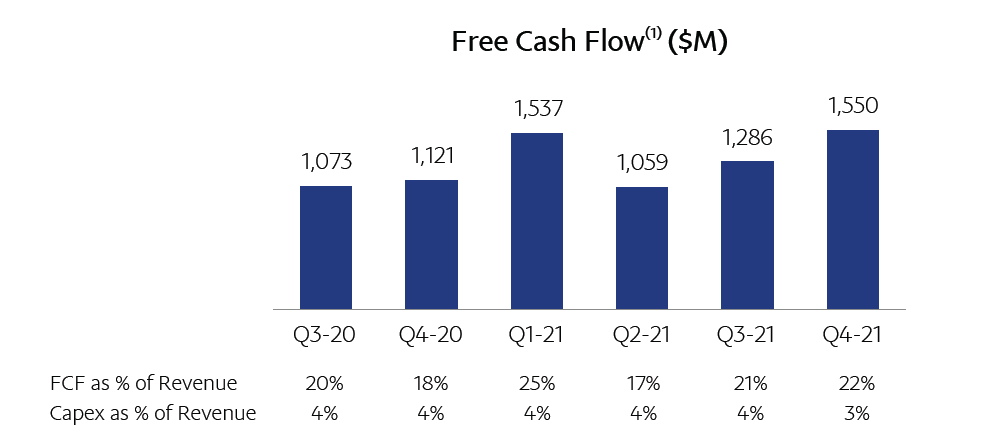

This highlights to investors the consistent cash-generative, and profitable, nature of PayPal’s business. In fact, PayPal’s free cash flow makes up a sizeable 22% of its overall revenue (see below).

Source: PayPal Q4 2021 earnings presentation

Source: PayPal Q4 2021 earnings presentation

One reason for PayPal’s recent underperformance was CEO Dan Schulman dropping the company’s 2025 target of hitting 750 million users. It also slashed its 2022 outlook for new users to 15-20 million accounts.

However, the firm’s plan to focus on better monetising its current users via its various initiatives and platforms, such as Venmo, is something positive.

Finally, zoom out further and shareholders over the past five years have still seen a strong positive share price return of an impressive 168.8%.

2. Veeva Systems

When we think of cloud Software-as-a-Service (SaaS), we automatically gravitate towards cybersecurity stocks or those in data management.

Yet in healthcare, SaaS companies are also helping firms become more efficient. One of the biggest healthcare SaaS firms is Veeva Systems Inc (NYSE: VEEV).

Operating as a cloud provider for the global life sciences industry, Veeva’s clients include pharmaceutical and life sciences companies.

With specific requirements for healthcare firms, Veeva works closely with its clients to ensure a secure and efficient cloud architecture.

That has translated into stable growth. In its latest fiscal fourth quarter 2022 (for the three months ending 31 January 2022), Veeva saw its revenue rise 22% year-on-year to US$485.5 million.

It also possesses a rare quality as a tech stock; it’s actually profitable. In the latest quarter, Veeva generated US$119.7 million in operating income and net income of US$97.1 million.

It finishes its latest fiscal year with a record 1,205 customers, up from just under 1,000 from the year before.

With shares down nearly 16% so far in 2022, Veeva offers investors a stable growth tech stock in a traditionally defensive sector.

3. Zoom Video

Finally, there’s Zoom Video Communications Inc (NASDAQ: ZM). Nothing sums up the Covid-19 pandemic than the shift towards stay-at-home work and the onset of Zoom calls.

Yet with the return to offices, many investors seem to think that remote work will be a thing of the past. That’s mistaken.

It’s true that Zoom’s year-on-year revenue growth has slowed considerably, from north of 350% at one point during the pandemic, to 21% in its most recent quarter.

However, the company is still pulling in over US$1 billion per quarter, with US$209 million in operating cash flow and US$274 million in adjusted free cash flow during its latest three-month period.

Add to that that Zoom had 2,725 customers contributing over US$100,000 in trailing 12-month revenue in its latest quarter – up 66% year-on-year – and it becomes clear that a “hybrid” model of work seems likely to persist post-Covid.

With a cash position of US$5.4 billion, Zoom also has the firepower to go out and acquire if it wishes to.

Shares of Zoom are down 33% so far this year while over the past year they’re down a whopping 62%.

With a much more reasonable valuation today, and an arguably stronger business than last year, Zoom looks like a quality business selling at a discount.

Continue to invest for the long term

High growth stocks, like value stocks, will see periods where investors aren’t keen on them. We should just remember to keep investing in quality.

As investors, it’s also important we have a diverse portfolio that has both components of growth and stability, preferably via dividends.

With current share prices offering compelling entry points for long-term investors, PayPal, Veeva Systems and Zoom Video today could turn out to be astute long-term investments in five years’ time.

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares of PayPal Holdings Inc and Zoom Video Communications Inc.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.