For any tech investor, China’s market offers up appetising growth in lots of areas. One such area is ride-hailing, where China’s version of Uber Technologies Inc (NYSE: UBER) dominates.

China-based DiDi Global Inc (NYSE: DIDI), better known as Didi Chuxing, is a veritable giant of the ride-hailing business in its home country, where it has a dominant 80% market share for rides.

Earlier this week, it finally listed shares on the New York Stock Exchange. Didi raised US$4 billion at US$14 per share – at the high end of its targeted price range – giving it a market capitalisation of an already-sizeable US$67 billion.

Didi shares ended their first day of trading on Wednesday up by around 1% but saw a massive 16% spike on Thursday. Yet, should investors be bullish on Didi’s growth story?

Questions over growth trajectory

While Didi managed to ultimately drive Uber out of China’s ride-hailing market, the homegrown tech giant has issues of its own.

Surprisingly, while a lack of profitability within ride-hailing plagues the big players such as Uber and Lyft Inc (NASDAQ: LYFT), Didi’s core mobility business is profitable (on an adjusted earnings basis).

In the first quarter of this year, Didi posted US$6.4 billion in revenue, which was up 107% year-on-year as ride numbers bounced from their Covid-19 lows during the first quarter of 2020.

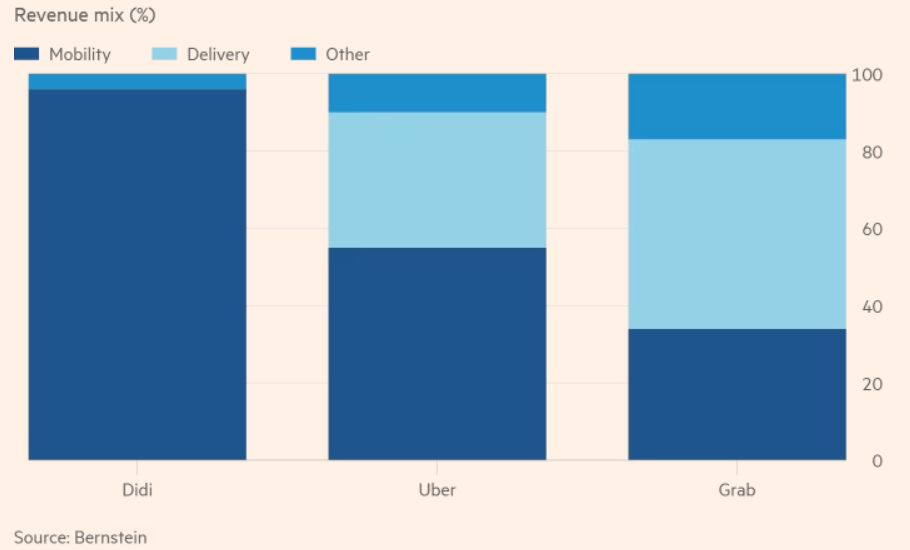

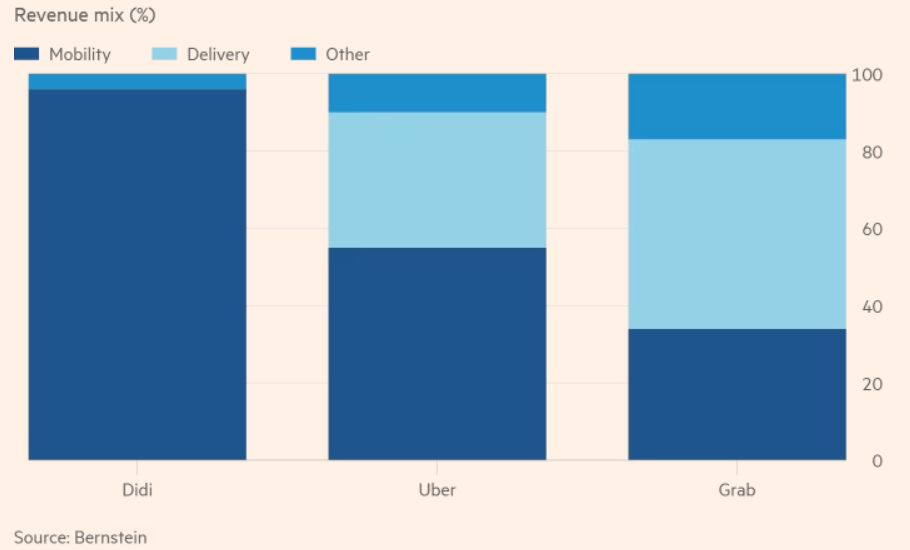

Yet a big issue for growth in that Didi (like Lyft) generates nearly all its revenue from rides.

That’s in stark contrast to Uber and Singapore-based Grab, both of which at least have food delivery businesses that provide a more promising route to eventual profits (see below).

While it has pumped money into shared bikes, intra-city freight, group buying and expanding its overseas presence – it operates in Brazil, Mexico, Australia and Japan – the extent to which Didi can grow in these different (no doubt, competitive) niches is still a huge question mark.

Structurally, the ride-hailing business in China has positive tailwinds. China has much greater population density than the US and less car ownership but for long-term investors, the story behind Didi needs to be a lot more compelling than this.

Sources: Bernstein, FT.com

Sources: Bernstein, FT.com

Disclaimer: ProsperUs Head of Content Tim Phillips doesn’t own shares of any companies mentioned.

Sources: Bernstein, FT.com

Sources: Bernstein, FT.com