In the current environment, investors are finding themselves moving away from growth stocks given rising interest rates.

Instead, value stocks and those that pay consistent (as well as reliable) dividends are in demand.

That sets the stage up perfectly for Singapore real estate investment trusts (REITs) to perform well.

One of the strongest, and perhaps recession-resistant, REITs is healthcare-focused Parkway Life REIT (SGX: C2PU).

With uncertainty rife in stock markets, Parkway Life REIT reported its first-quarter 2022 business update at the end of last week.

Here’s what REIT investors need to know about this rock-solid REIT’s latest quarter.

Revenue and NPI up slightly

For the first quarter of 2022, Parkway Life REIT saw its revenue rise 2.3% year-on-year to S$30.7 million, up from S$30.0 million in the same quarter a year earlier.

Meanwhile, net property income (NPI) was up by 1.9% year-on-year to S$28.6 million during the first quarter of this year.

Management attributed the rise in revenue to three acquisitions it completed in 2021 and the higher rent from Singapore hospitals.

However, this was partially offset by the loss of income from the divestment of a non-core asset and the depreciation of the Japanese Yen.

Fundamentals remain robust

Parkway Life REIT’s fundamentals, as always, remains exceedingly robust. Its all-in debt cost is a barely-believable 0.56%, a ridiculously low number by the standards of Singapore REITs.

Meanwhile, its gearing ratio remains healthy at 34.5% and it has a more than sufficient buffer, with an interest coverage ratio of 20.2x.

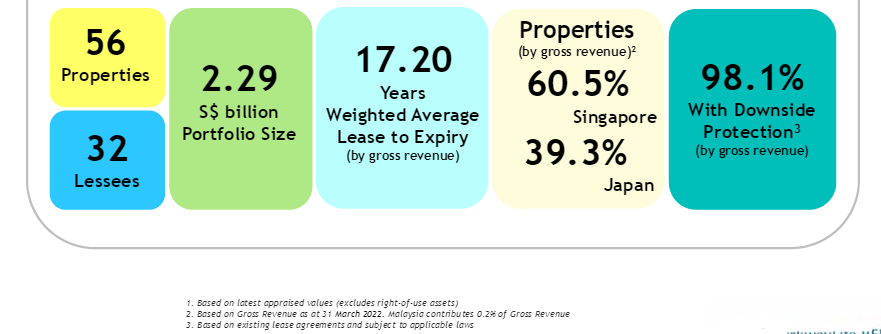

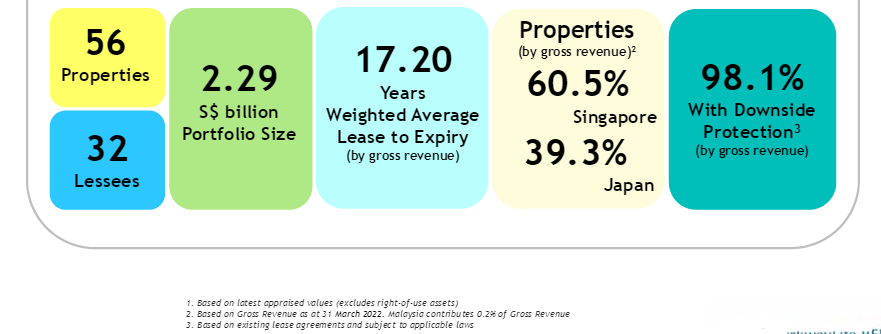

In terms of its portfolio characteristics, it’s what you’d term “bullet-proof” with a weighted average lease expiry (WALE) of 17.2 years and downside protection on nearly 100% of its portfolio (see below).

Source: Parkway Life REIT Q1 2022 business update presentation

Source: Parkway Life REIT Q1 2022 business update presentation

The REIT did execute some new hedges on its Japanese Yen exposure in March of this year, meaning that around 81% of its interest rate exposure is now hedged.

Business as usual for Parkway Life

It was another solid quarter from the healthcare REIT and what Parkway Life REIT shareholders have come to expect from this consistent performer.

Since its IPO in 2007, the REIT has grown its total distribution per unit (DPU) by 122.8%.

Despite fears of a recession in the US, high inflation and supply chain disruptions from China’s Covid-19 lockdown, the healthcare properties that Parkway Life REIT owns are likely to continue to do well.

That’s maybe one reason why Parkway Life REIT shares offer a dividend yield of only 2.9%, based on its latest price of S$4.89.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares of Parkway Life REIT.

Source: Parkway Life REIT Q1 2022 business update presentation

Source: Parkway Life REIT Q1 2022 business update presentation