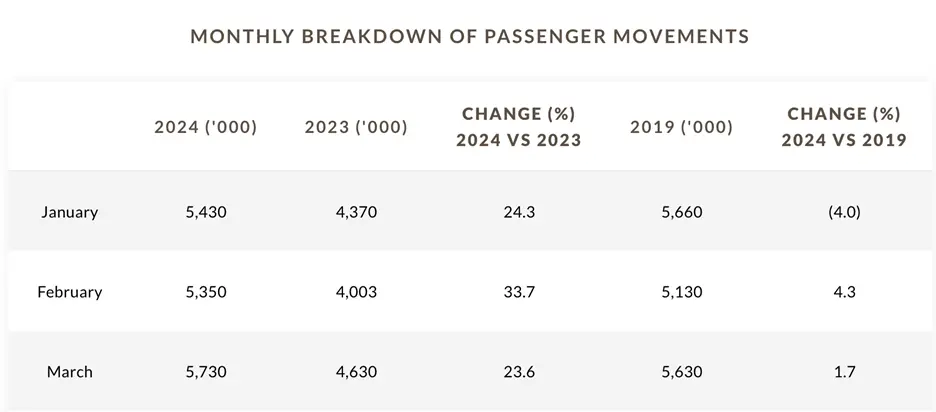

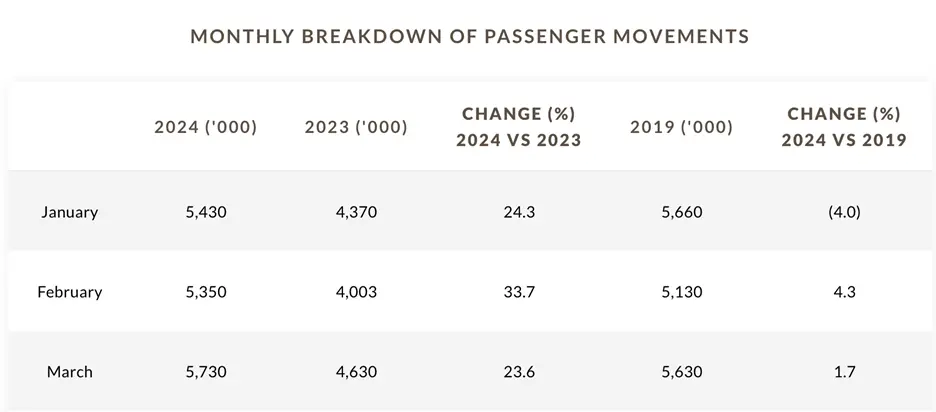

Singapore’s Changi Airport has experienced a significant resurgence in tourism and air travel, marking a robust recovery that surpasses pre-pandemic levels. In the Q1 2024, the airport recorded 16.5 million passenger movements, marginally edging out the figures from the same period in 2019. This recovery has been fueled by strong month-over-month growth, with February seeing a 4.3% increase in passenger movements compared to 2019, underscoring a vigorous rebound. The easing of visa restrictions, particularly the mutual 30-day visa exemption with China that began in February, has significantly boosted travel numbers, making China the top market for Changi in the quarter.

Source: Changi Airport

This rebound is not limited to passenger traffic; airfreight throughput has also seen a notable increase, marking a 14% year-over-year growth to 475,000 tonnes in the first quarter, the first increase after seven quarters of decline. The revitalisation of the airfreight sector is largely attributed to robust transshipment activities, especially involving China. Such developments at Changi Airport reflect a broader recovery trend within Singapore’s tourism and aviation sectors, with the airport now connecting to 153 cities across 48 countries. With ongoing collaborations with airlines and travel partners, Changi Airport is poised to continue its growth trajectory, aiming to reach full traffic recovery within the year, further enhancing its role as a critical hub in the Asia-Pacific region.

This is likely to have a cascading positive effect on various related stocks, including SATS Ltd (SGX: S58), Frasers Hospitality Trust (SGX: ACV), ComfortDelGro Corporation Ltd (SGX: C52), CapitaLand Integrated Commercial Trust (SGX: C38U), CapitaLand Ascott Trust (SGX: HMN), Singapore Airlines Ltd (SGX: C6L), and Genting Singapore Ltd (SGX: G13).

- SATS, being a chief provider of gateway services and food solutions, stands to gain directly from the increased passenger movements through Changi Airport. More flights and passengers mean higher demand for its ground and in-flight catering services.

- Frasers Hospitality Trust, which focuses on hospitality real estate, will benefit from the uptick in international visitors. As occupancy rates improve with the influx of tourists, revenue per available room (RevPAR) is likely to see a boost, strengthening the trust’s financial performance.

- ComfortDelGro, one of the largest land transport companies, is poised to see growth in demand for its taxi and private hire services as more travelers require transportation to and from the airport and around the city.

- CapitaLand Integrated Commercial Trust, which holds a portfolio of retail and commercial properties, is poised to benefit from the surge in business and leisure travel, as a busy airport often translates into heightened commercial activity. We will also likely to see an uptick in foot traffic at its Singapore malls.

- CapitaLand Ascott Trust, with its serviced residences, stands to gain from the increased airport traffic as well, with expectations for longer guest stays due to the uptick in travel. A bustling airport typically leads to more vibrant commercial activity and longer stays in serviced residences.

- Singapore Airlines, the flag carrier, is expected to be a primary beneficiary of the surge in air travel. With the introduction of new routes and increased flight frequencies, Singapore Airlines is well-positioned to capture a significant share of the rising air traffic.

- Genting Singapore, which operates leisure and entertainment facilities, will likely see a rise in visitors seeking entertainment options, boosting its overall business.

In summary, these seven stocks are connected to the travel and hospitality ecosystem, which is currently on an upward trend. Investors might view these stocks as opportunities to leverage Singapore’s tourism recovery, with each company poised to benefit from different aspects of the increasing number of visitors to the city-state.

Disclaimer: ProsperUs Head of Content & Investment Lead Billy Toh doesn’t own shares of the company mentioned.