- US Exposure – Malaysian companies in sectors like gloves and technology generate significant revenue from the US, making them sensitive to trade policy and demand shifts.

- China Exposure – A weaker Chinese economy may impact Malaysian firms tied to logistics and petrochemicals.

- KLCI Forecast – Our index target has been revised down to 1,680, though anticipated US rate cuts could bring foreign investors back to Malaysia equities.

Trade tensions between the world’s two largest economies—the United States and China—are more than just headlines. For Malaysian investors, these developments can create ripple effects across portfolios. Within our coverage universe, several Bursa Malaysia companies derive a significant portion of their revenue from the US or China. When trade frictions escalate, they can weigh on earnings and investor sentiment.

US Exposure Sectors

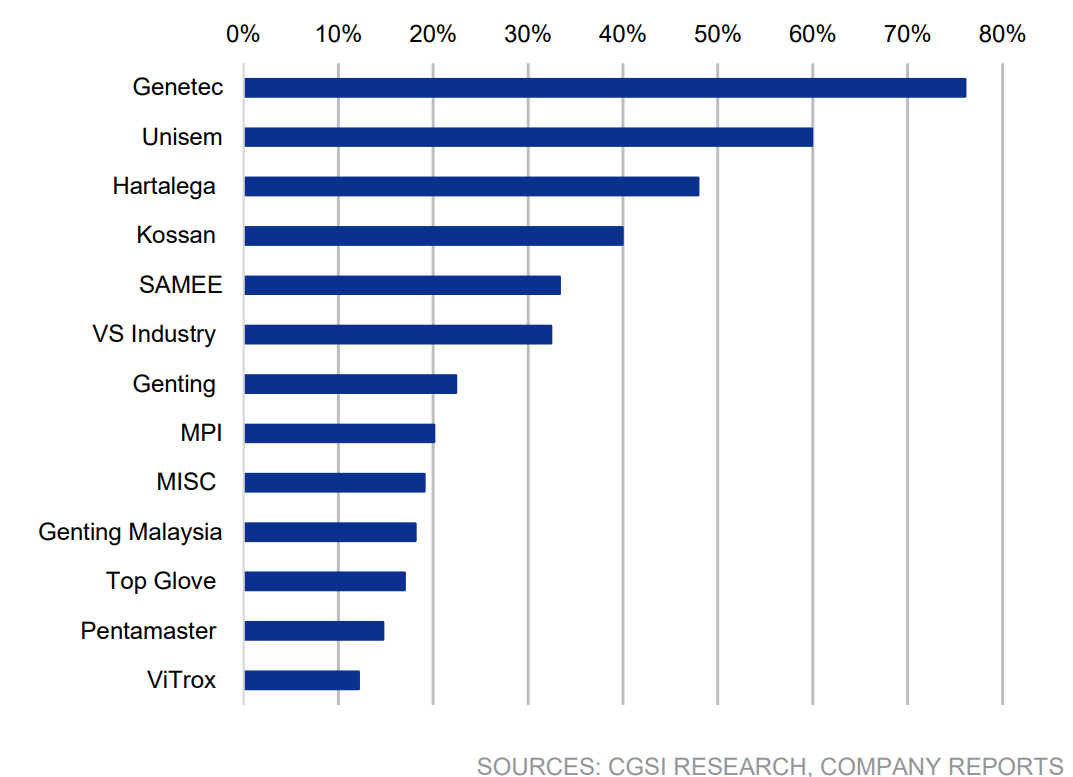

Based on our analysis of Malaysian equities, the main sectors with relatively high exposure to the US include:

- Gloves: Malaysian glove manufacturers like Hartalega Holdings Bhd (KLSE: 5168) derive 48% of revenue from the US. US tariffs on Chinese products could make Malaysian exports more competitive. However, global oversupply—especially from China—might limit price gains.

- Technology: This sector remains exposed to external risks. Genetec Technology Bhd (KLSE: 0104) and Unisem (M) Bhd (KLSE: 5005) earn approximately 75% and 60% of their revenues from the US, respectively, making them vulnerable to changes in demand and trade disruptions.

- Gaming: A slowdown in US consumer spending could reduce footfall at casinos. Genting Bhd (KLSE: 3182), which operates Resorts World properties in the US, generates about 20% of its revenue from that market.

Local Stocks with US Revenue Exposure

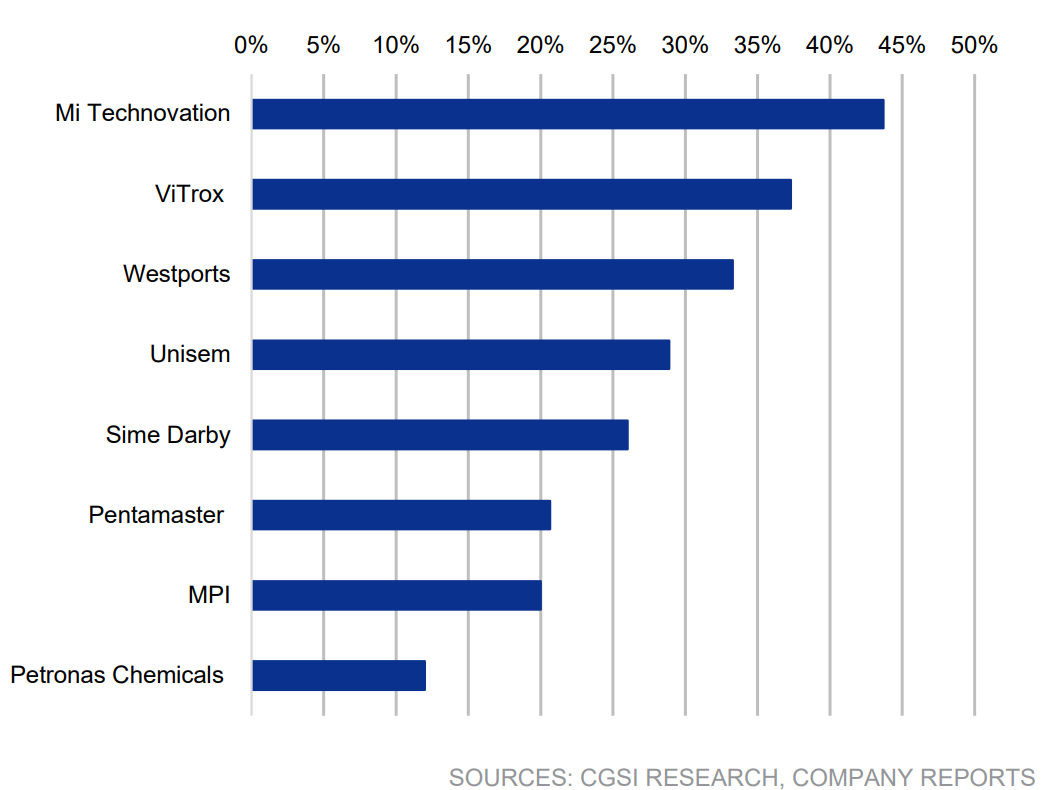

China Exposure Sectors

China’s economic slowdown, driven by trade war effects, can reduce demand for Malaysian exports — especially in logistics, automotive, technology and petrochemicals. Malaysian companies with high China exposure could feel the pinch. These include Mi Technovation Bhd (KLSE:5286), with nearly 45% of its revenue from China; Westports Holdings Bhd (KLSE: 5246) estimate at 33%; Sime Darby Bhd (KLSE: 4197) at 26%; and Petronas Chemicals Group Bhd (KLSE: 5183) at 12%.

Local Stocks with China Revenue Exposure

KLCI Outlook

The Kuala Lumpur Composite Index (KLCI), which represents Malaysia’s top 30 listed companies, has around 5% direct revenue exposure to China and 0.5% to the US. Due to ongoing trade tensions, we’ve lowered our KLCI target from 1,770 to 1,680 by end-2025.

Notably, the Malaysian market has experienced foreign outflows totaling RM20 billion over the past seven months. However, the prospect of US interest rate cuts could help reverse this trend, improving capital flows and attracting foreign investors back to Malaysian equities in the medium term.

Conclusion

Overall, we find that the direct exposure of Malaysian stocks to the US and China remains manageable, though ongoing trade policy changes add a layer of uncertainty. Understanding the exposure of sectors and companies to these two major economies can help you navigate potential risks and seize opportunities.

In the current market volatility, we recommend staying selective—consider dividend stocks like CIMB Group Holdings Bhd (KLSE:1023), expected to yield 7% in 2025, and long-term growth plays like consumer staple Fraser & Neave Holdings Bhd (KLSE:3689).

Disclaimer: Hailey Chung, Manager of Content at ProsperUs, does not own shares of any companies mentioned.