1 Rock-Solid Singapore REIT to Buy for Your SRS

July 11, 2023

Interest rates are high. Inflation is raging. Stock markets have been volatile. It’s not been a great couple of years for investors globally.

Here in Singapore, we have seen the big Singapore banks do well on the back of rising rates. However, another big part of the SGX is the presence of Singapore REITs.

Unfortunately for shareholders, the unit prices of those mostly fell in 2022 as the US Federal Reserve ramped up rates at a fast clip.

Now that they’re so shunned, though, it might be time for long-term investors to revisit specific S-REITs.

One of the best ways to take advantage of this longer term is by investing in REITs via the Supplementary Retirement Scheme (SRS).

That’s because you can put money away for retirement and invest it – all while also saving on income taxes every year.

So, here’s one rock-solid Singapore REIT that any investor can buy for their SRS account.

Mapletree Logistics Trust – Riding on regional trends

Mapletree Investments Pte have a variety of listed in REITs in Singapore that it sponsors and the second-largest of those is Mapletree Logistics Trust (SGX: M44U).

The REIT is a constituent member of the Straits Times Index (STI) and has a market capitalisation of S$8.1 billion.

It carried out its initial public offering (IPO) in 2005 and had 15 properties valued at S$422 million at the time.

Today, Mapletree Logistics Trust is a much bigger beast with 185 properties valued at S$12.8 billion (as of 31 March 2023).

It also has a pan-Asia presence with properties in Singapore, Hong Kong, Mainland China, Australia, Japan, South Korea, Vietnam, Malaysia, and India.

Mapletree Logistics Trust has many grade-A properties close to key expressways and airports across Asia and has still be able to acquire in the rising interest rate environment.

Moving up exposure to Japan

One of the most recent acquisitions it carried out was a bulk purchase of eight logistics assets in Japan, Australia, and South Korea.

Six of those eight assets, though, are in Japan – which is seeing strong demand for logistics space but a limited amount of supply in key cities such as Tokyo.

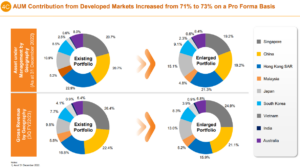

Post-completion of the deals, Mapletree Logistics Trust’s portfolio will see more of its assets under management (AUM) coming from developed Asia markets (see below).

That should help quell some concerns around the vulnerability of its China portfolio (given the slowing growth there), which will take up a lesser percentage of its AUM and gross revenue.

Source: Mapletree Logistics Trust investor relations presentation, 30 March 2023

Growing its dividend sustainably

One of the big things that a lot of Singapore REIT investors miss out on is how sustainable a REIT’s dividend (or distribution) is over the long term.

The last thing we want when we put our SRS money to work is for the dividend of a REIT we’re invested in to be cut.

That will likely hit the share price and negatively impact its returns over the longer term. Thankfully, Mapletree Logistics Trust has done a good job of growing its dividend over time.

Mapletree Logistics Trust paid out a distribution per unit (DPU) of 5.07 Singapore cents in its first full year after listing (FY2006).

In its most recent full-year earnings (FY2023) for the 12 months ending 31 March 2023, the REIT posted a DPU of 9.011 Singapore cents.

That equates to a compound annual growth rate (CAGR) in its DPU of 3.7% over the span of 16 years.

Focus on long-term success for your SRS

When we think about individual stocks or REITs to invest in using our SRS funds, it’s best to stick to conservative and well-known blue chips.

Mapletree Logistics Trust is a prime example of that and has demonstrated its ability to keep growing its portfolio while also rewarding unitholders with consistent DPU increases over long stretches of times.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares of Mapletree Logistics Trust.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.