3 Best Bank Stocks That Temasek Owns: FY2023 Year in Review

July 17, 2023

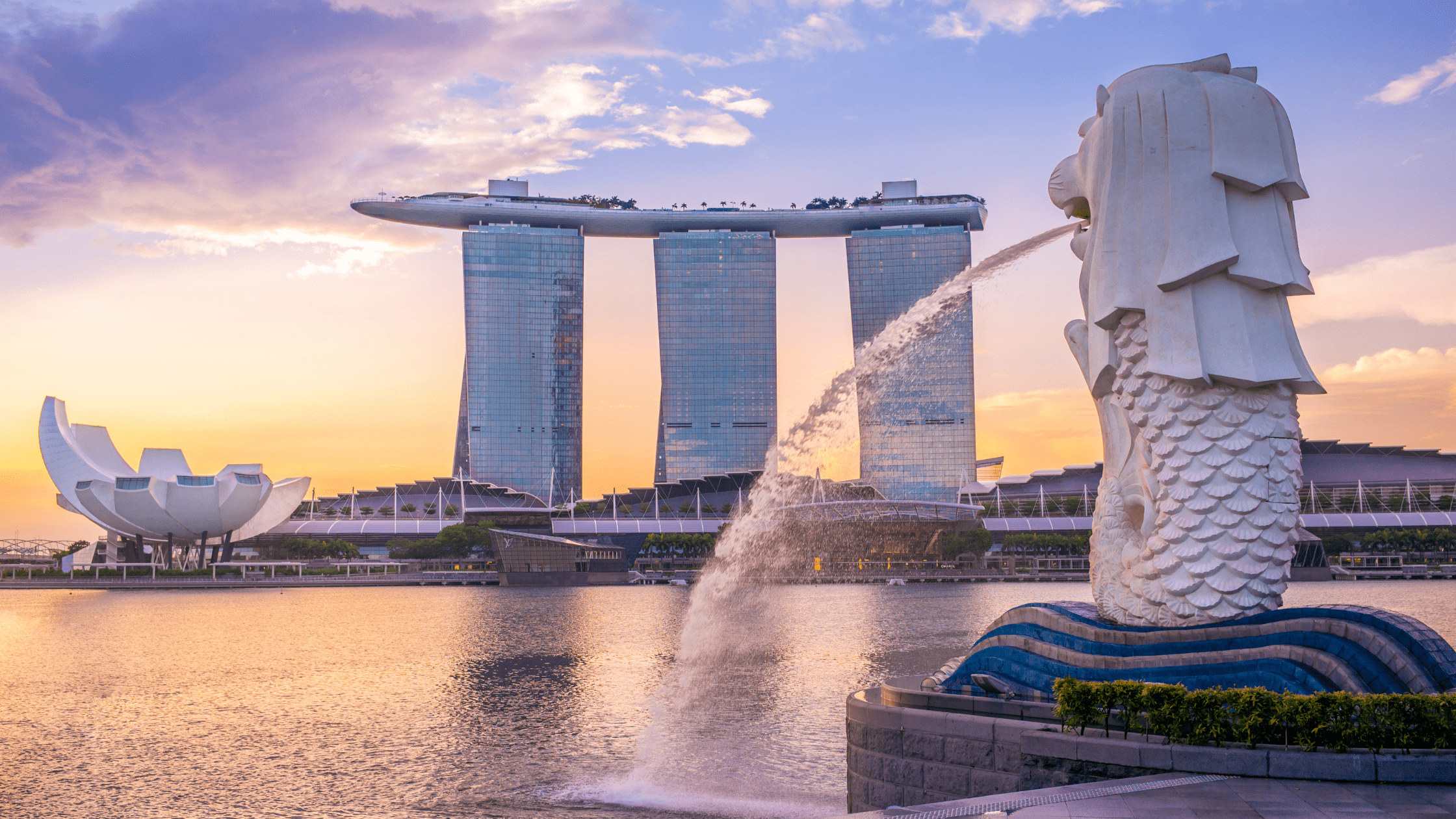

All Singapore investors and Singaporeans know about Temasek – the professionally-run investment company that’s wholly-owned by the Singapore government.

That’s because a lot of its investment returns also contribute towards the country’s budget. Therefore, all Singaporeans have a vested interest in how its investment performance stacks up.

Recently, Temasek released its Temasek 2023 Review, which looked at its portfolio’s returns for its latest 2023 financial year (for the 12 months ending 31 March 2023).

Temasek’s one-year total shareholder return (TSR) saw a decline of -5.1% in Singapore dollar terms. However, given the volatile macroeconomic environment, it was a commendable performance.

The fact that Temasek has a lot of investment exposure to the Singapore stock market – through its various holdings – also helped mitigate some of the losses in other markets.

Yet, Temasek also had some publicly-listed holdings that delivered strong positive returns during the period. That’s particularly true in the financials sector, where banks have benefitted from higher interest rates.

So, with that in mind, here are Temasek’s three top-performing bank stock holdings in its FY2023.

1. Standard Chartered PLC – TSR of +22.9%

A lot of investors may not be aware of Standard Chartered PLC (LSE: STAN), a London-listed but Emerging Markets-focused bank.

It saw a TSR of +22.9% for Temasek in the 12 months ending 31 March 2023.

The bank also has a strong presence in Hong Kong, having had a long and storied history in the city, along with a Hong Kong listing on the Hong Kong Stock Exchange.

The bank saw a strong FY2022, with revenue up 9.5% year-on-year to US$15.5 billion. Standard Chartered’s full-year pretax profit of US$4.3 billion for 2022 was up 28% year-on-year from the number it posted in FY2021.

The bank has also received positive attention from investors after it announced a US$1 billion share buyback programme in February of this year.

That was on the back of a strong improvement in its return on tangible equity (ROTE), which management estimates will approach 10% this year before exceeding 11% in 2024.

Yet the bank’s performance still appears to be mixed. Its wealth management arm reported a 17% drop in income as investors became more risk averse.

The bank’s share price is still languishing more than 20% below where it stood in 2015, when current CEO Bill Winters took over.

Standard Chartered’s London-listed shares are currently giving Temasek a dividend yield of 3.1%.

2. ICICI Bank – TSR of +20.8%

Indian banks have been some of the best investments in the financial sector globally over the past decade.

That’s why it was no surprise to see large Indian private-sector lender ICICI Bank Ltd (NSE: ICICIBANK) (NYSE: IBN) make Temasek’s list of top-performing financials, with a TSR of +20.8%.

In fact, in FY2023 (for the 12 months ending 31 March 2023), ICICI Bank reported a profit after tax of INR 319 billion (US$3.89 billion), up an impressive 36.7% year-on-year.

Meanwhile, ICICI Bank’s domestic loan portfolio expanded by 20.5% year-on-year – demonstrating the incredible growth opportunities that the Indian economy is generating.

India’s economy is one of the fastest-growing in Asia, with GDP growth in Q1 2023 accelerating to 6.1%.

Given ICICI Bank is more of a growth stock, rather than traditional dividend payer, the bank only provides a dividend yield of 0.8%.

However, its Indian-listed shares have increased by 260% over the past five years.

3. HDFC Bank – TSR of +10.8%

One of the world’s best-performing bank stocks over the past two decades has been India’s largest private lender, HDFC Bank Ltd (NSE: HDFCBANK) (NYSE: HDB).

Over the past 10 years, HDFC Bank’s India-listed shares are up over 390%. The bank just reported its Q1 FY2024 (for the three months ending 30 June 2023) numbers and they were impressive.

The bank reported a net profit of INR 199.5 billion for the quarter, up 30% from the same period last year.

HDFC Bank’s gross non-performing assets (NPA) ratio increased slightly by five basis points to 1.17% during the quarter. However, the bank’s total deposit base was up strongly, increasing by 19.2% year-on-year.

It was the bank’s first earnings release following its merger with its parent company Housing Development Finance Corporation (HDFC), a diversified housing finance company that is also India’s largest mortgage lender.

Given its new level of scale – it will be the fourth-largest bank by market cap in the world – HDFC Bank should be able to better exploit potential growth opportunities in the Indian market.

Now standing with a market cap of US$170 billion, HDFC Bank looks well positioned to grow even further in the years ahead.

Thinking about growth opportunities in Asia

Overall, Temasek has a very well-diversified portfolio. What stands out, though, is that it is very bullish on the Asian growth story.

Its S$382 billion portfolio has over 63% exposure to Asia, including 28% in Singapore alone. Among that 63% are some strong banks, including the likes of ICICI Bank and HDFC Bank.

While there are also other investment opportunities elsewhere, Temasek’s financial portfolio reflects the idea that Asia’s growth story – particularly India’s – should continue in the decade ahead.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.