3 Key Highlights from Frasers Centrepoint Trust’s H1 FY2023 Earnings

April 27, 2023

Frasers Centrepoint Trust (SGX: J69U), also known as FCT, reported a 5.7% year-on-year (yoy) increase in net property income for its H1 FY2023, according to its most recent business update.

Although net property income (NPI) rose and distributable income grew by 0.3% to S$104.68 million, the distribution per unit (DPU) actually experienced a slight decline of 0.1% yoy, settling at 6.130 Singapore cents.

So, for Singapore REIT investors, here are three key highlights from Singapore’s largest suburban shopping malls owner.

1. High occupancy rate and improved tenant sales will keep rental reversion positive

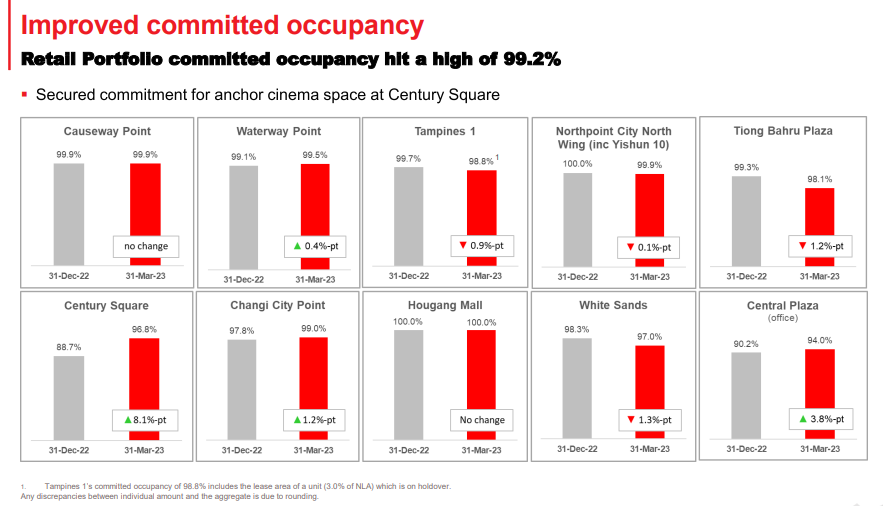

One of the key highlights for Frasers Centrepoint Trust was the high occupancy rate of 99.2% achieved by the retail portfolio.

Source: FCT’s H1 FY2023 Results Presentation

The high occupancy rate was mainly due to the anchor cinema space at Century Square.

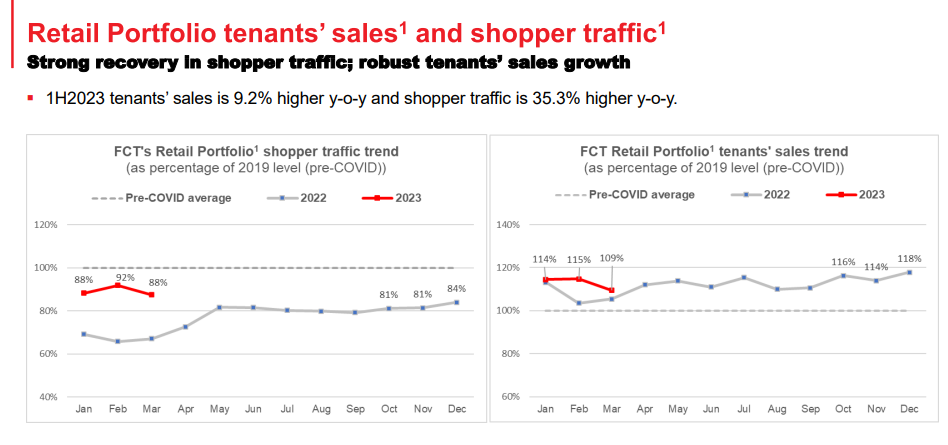

This is in line with the recovery in the retail space. Tenant sales rose 9.2% yoy in H1 FY2023 to surpass pre-Covid levels while shopper traffic was 35.3% higher as compared to a year ago.

That means traffic footfall improved to 89% of pre-Covid-19 levels in Q1 CY23 as compared to 82% in Q4 CY22.

FCT’s manager said that the REIT “benefitted from the continued recovery following Singapore’s transition to the COVID-19 endemic phase and delivered a very healthy set of results” in its H1 FY2023.

Source: FCT’s H1 FY2023 Results Presentation (1 Excludes NEX)

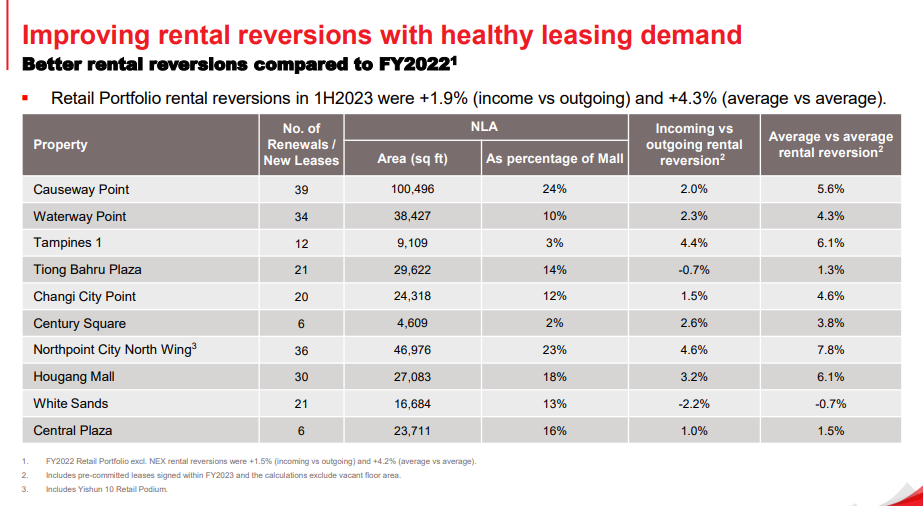

In line with the higher occupancy rate and improvement in tenant sales and the retail market, FCT also saw improved rental reversions with healthy leasing demand during H1 FY2023.

During H1 FY2023, the average rental reversion for the retail portfolio saw a positive increase of 1.9% on an incoming versus outgoing basis and a positive growth of 4.3% on an average-to-average basis.

Both figures are higher compared to the same period in the previous year.

Source: FCT’s H1 FY2023 Results Presentation

The high occupancy rate, recovery of the retail sector and improved tenant sales to above the pre-COVID levels is likely to sustain FCT’s positive rental reversion in the near term.

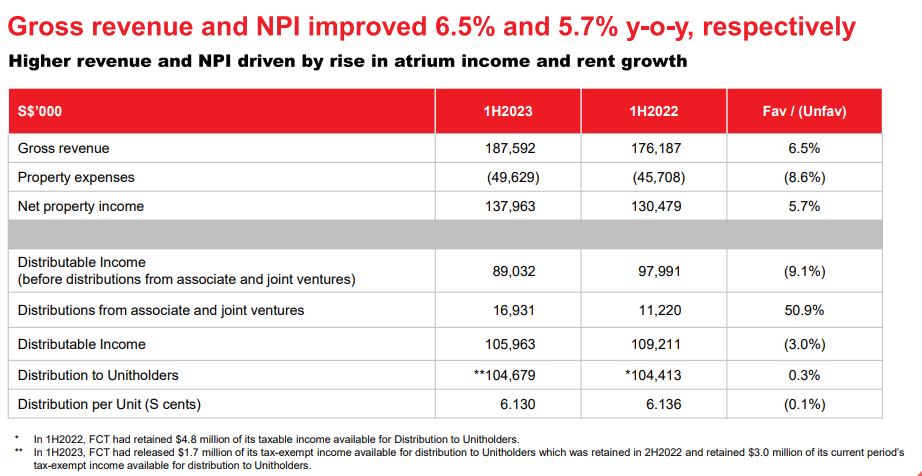

2. Gross revenue and NPI grew despite headwinds

Source: FCT’s H1 FY2023 Results Presentation

Gross revenue increased by 6.5% to S$187.6 million from S$176.2 million in the same period last year, primarily due to higher staggered rent, higher rental rates from renewed leases, and increased atrium income as events resumed on 29 March, 2022.

Net property income for the half-year saw a 5.7% year-on-year growth, reaching S$138 million, up from $130.5 million.

Distributable income also rose by 0.3%, amounting to S$104.7 million compared to S$104.4 million in the year-ago period.

The manager retained S$3 million in tax-exempt income for distribution to unit holders but released S$1.7 million of previously retained income available for distribution in the second half of 2022.

FCT CEO, Mr. Richard Ng, highlighted the positive lease renewals and new tenant signings despite challenges from rising interest rates and operating costs, which were driven by improved retail sentiment and healthy consumer spending.

He also observed a growing trend of consumers focusing their spending on essential goods and services, which is favourable for FCT’s retail portfolio.

3. Downside risks include rising debt and consumer spending slowdown

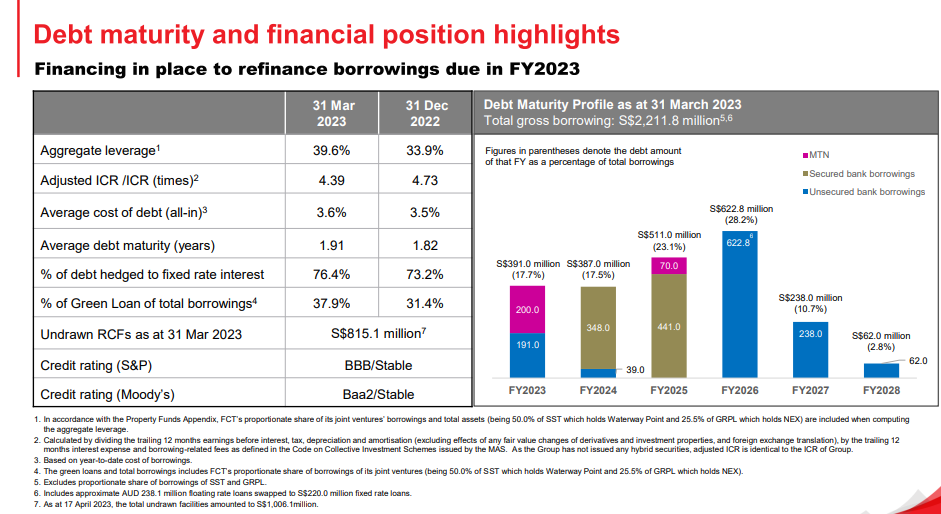

The completion of the acquisition of a 25.5% stake in NEX and an additional 10% stake in Waterway Point in February this year will drive NPI but rising debt is a concern.

FCT’s gearing rose significantly from 33.9% to 39.6% quarter-on-quarter (qoq) due to the debt-financed acquisitions earlier this year.

FCT’s current gearing is higher compared to the 33-36% range seen in its recent past.

The average cost of debt increased to 3.6%, which is an increase of 10 basis points (bps) qoq and 140 bps yoy.

The higher volume of outstanding loans resulted in a 35% growth in finance expenses, which lead to a decline in its interest coverage ratio (ICR) to 4.4 times in the H1 FY2023, from 5.7 times a year ago.

Financing is already in place to finance borrowings due in FY2023, which could result in higher interest cost given the rising interest rate environment.

On a positive note, the management shared that maintaining higher debt headroom is advantageous for pursuing acquisitions and expressed their intention to consider divesting underperforming assets.

Additionally, they would strategically utilise equity fundraising to reduce gearing or capitalise on acquisition opportunities when the timing is right.

Another downside risk for FCT includes a sharp slowdown in consumer spending in the event of a global recession as it would weaken its ability to maintain positive rental reversions.

Source: FCT’s H1 FY2023 Results Presentation

Singapore REIT focused on its resilient economy

Overall, the trends continue to be positive for Frasers Centrepoint Trust.

For investors who are looking to tap into the resilience Singapore’s economy, FCT is a solid way of gaining exposure to Singapore consumers given its exposure to suburban malls.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.