Frasers Logistics & Commercial Trust: Is the REIT a Buy After Earnings?

November 15, 2021

While we are nearing the tail end of the third-quarter earnings season, there are still some big Singapore real estate investment trusts (REITs) reporting numbers.

One of the biggest REITs that released results last week was Frasers Logistics & Commercial Trust (SGX: BUOU).

Frasers Logistics & Commercial Trust is the result of a merger between two listed Singapore REITs; Frasers Logistics Trust and Frasers Commercial Trust.

As I’ve written about previously, that merger was a perfect example of how, for a number of reasons, “bigger is better” when it comes to Singapore REITs.

So, should investors consider buying Frasers Logistics & Commercial Trust shares after its latest H2 fiscal year (FY) 2021 (for the six months ended 30 September 2021) earnings?

Strong foundations and dividend growth

The REIT is a constituent of Singapore’s benchmark Straits Times Index (STI), having joined the index in April of this year.

Also known as “FLCT”, it owns 103 logistics and commercial properties across Singapore, Australia, Germany, the Netherlands and the UK.

Some of the commercial properties the REIT owns in Singapore, which investors might be familiar with, include Cross Street Exchange and Alexandra Technopark.

FLCT’s latest earnings showed resilience in its portfolio, with adjusted net property income (NPI) in the second half of FY 2021 up 12.3% year-on-year to S$181.3 million.

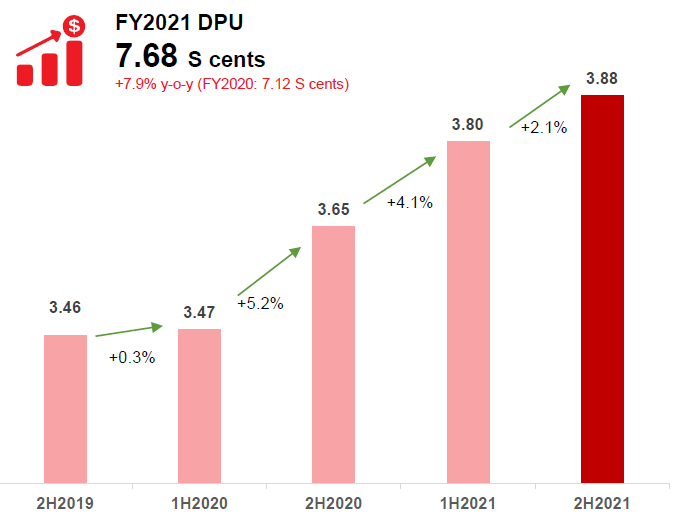

Meanwhile, the crucial final distribution per unit (DPU) for the second half FY 2021 saw a nice bump – up 6.3% year-on-year to 3.88 Singapore cents.

FLCT pays out a dividend only twice a year – an interim and final dividend – although looking at its latest full-year 2021 that DPU expanded by an even better overall rate of 7.9% year-on-year to 7.68 Singapore cents.

More importantly, that DPU has been growing at an increased rate (see below) ever since the merger between Frasers Logistics Trust and Frasers Commercial Trust was completed in late April 2020.

Source: Frasers Logistics & Commercial Trust H2 FY2021 earnings presentation

Source: Frasers Logistics & Commercial Trust H2 FY2021 earnings presentation

Solid financial metrics

When investing in REITs, we have to be sure there are specific metrics that a REIT can meet before it receives your money.

In terms of FLCT, one of its strongest points is its gearing ratio which stood at just 33.7% at the end of September, down 2.7 percentage points from 30 June 2021.

That’s well below the 50% regulatory minimum set by the Monetary Authority of Singapore (MAS) and allows the REIT to pursue acquisition opportunities in future.

Meanwhile, interest coverage ratio (ICR) was at a robust 7.3x at the end of the period while the weighted average debt of maturity lengthened a little to 3.4 years.

Growing into 2022

Overall, it was a solid second half for Frasers Logistics & Commercial Trust. Heading into this new fiscal year and into 2022, the REIT has a solid asset base split by office and business parks, CBD commercial properties and logistics & industrial real estate.

In its latest update, FLCT management said that the retail segment of its commercial portfolio was the only part of its portfolio negatively impacted by Covid-19 during the quarter.

That “affected portion” only made up 1.7% of the REIT’s overall income in September, a negligible amount.

With a 12-month forward dividend yield of 5.1% and with demand for logistics properties growing across Europe, Singapore and Australia, Frasers Logistics & Commercial Trust shares look like a solid addition to any portfolio focused on generating long-term income.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.