Mapletree Logistics Trust: What REIT Investors Should Know About Its Q1 FY2024 Earnings

July 26, 2023

It’s shaping up to be a big week for Singapore’s REITs. That’s because a lot of the largest REITs listed on the SGX are reporting their quarterly numbers.

Coincidentally, it also comes as the US Federal Reserve wraps up its FOMC meeting later today (26 July). With an expected 25 basis point (bp) hike in the Fed Funds Rate, there’ll be further pressure on businesses that rely on debt to grow.

That’s unfortunate for Singapore REITs, which rely heavily on raising debt to grow their portfolios. However, many S-REITs are holding up commendably in this high interest rate environment.

One that has done relatively well is pan-Asia logistics-focused REIT Mapletree Logistics Trust (SGX: M44U).

The REIT, which is a Straits Times Index (STI) component stock, released its latest Q1 FY2024 results (for the three months ending 30 June 2023) on Tuesday (25 July) after the market close.

For dividend and Singapore REIT watchers, here’s what they should know about Mapletree Logistics Trust’s latest numbers.

Mapletree Logistics Trust’s revenue and NPI fall but DPU remains flat

It was another decent quarter for the second-largest SGX-listed Mapletree REIT. In Q1 FY2024, gross revenue was S$182.1 million, a decline of 2.9% year-on-year.

Meanwhile, net property income (NPI) fell 3.1% year-on-year to S$158.1 million during the period.

Revenue was down on the back of weaker exchange rates, particularly the depreciation of CNY, JPY, KRW, and AUD against the Singapore dollar.

This was partially offset by better performance in Singapore and the contribution of recent acquisitions in Japan and South Korea.

The REIT’s borrowing costs, unsurprisingly, were up 13.4% year-on-year as a higher average interest rate was the natural result the rise interest rate environment.

But, Mapletree Logistics Trust managed to keep its distribution per unit (DPU), or dividend, essentially flat – both on a quarter-on-quarter and year-on-year basis – at 2.271 Singapore cents.

Rental reversions higher but China weakness ahead

Mapletree Logistics Trust did see its average rental reversion for the quarter come in relatively strong at a positive +4.2%.

That came with a caveat though, as management stated that it would be adopting a tenant retention strategy given that 15% of its overall leases, up for renewal in FY2024, are properties in Tier-2 and Tier-3 Chinese cities.

The REIT’s management said these could deliver negative rental reversions of up to 10% upon renewal.

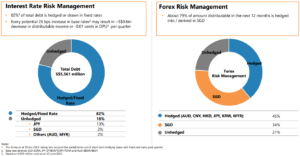

On the interest rate risk, Mapletree Logistics Trust has been responsible with 82% of its total debt on fixed rates as of 30 June 2023.

Meanwhile, around 80% of its distributable income in the next 12 months has been hedged into SGD (see below).

Source: Mapletree Logistics Trust Q1 FY2024 earnings presentation

Mapletree Logistics Trust continues to be proactive with asset recycling and completed the sale of two properties in Malaysia in July that had older specs and limited redevelopment potential.

Ongoing redevelopment work continues at 51 Benoi Road in Singapore, where the REIT hopes to increase the property’s gross floor area (GFA) by 2.3 times by Q1 FY2025.

Resumption of distribution reinvestment plan

Shareholders of Mapletree Logistics Trust might also be interested to know that the REIT resumed its distribution reinvestment plan (DRP) for its Q1 FY2024 DPU.

With leverage of 39.5%, as of 30 June 2023, management no doubt wants to use the DRP to hopefully get the gearing ratio down further in the coming quarters.

Overall, it was another in-line quarter for Mapletree Logistics Trust although investors should keep an eye on its China rental reversions in the coming quarters.

At its current share price, Mapletree Logistics Trust is giving REIT investors a 12-month forward dividend yield of 5.3%.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares of Mapletree Logistics Trust.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.