Singtel’s FY2023 Earnings: Here’s What Singapore Investors Need to Know

May 26, 2023

It’s been a tough environment for many businesses, given rising interest rates and higher inflation.

So, what should Singapore investors be buying? Many have focused on dividend stocks, whether it be Singapore’s big banks or Singapore REITs.

However, one of the other big dividend payers in the Singapore stock market is dominant telco Singapore Telecommunications Ltd (SGX: Z74), also known as Singtel.

Singtel is also a constituent member of the benchmark Straits Times Index (STI).

The company recently released its H2 FY2023 and FY2023 earnings (for the six months and 12 months ending 31 March 2023).

Here’s what Singapore investors and dividend seekers should know about the earnings from Singtel’s latest numbers.

Net profit and dividend both increase

For the full-year FY2023, Singtel saw its net profit increase 14% year-on-year to S$2.2 billion and its underlying net profit rise by 7% year-on-year to S$2.1 billion.

Both these figures exclude the NBN migration revenue and Amobee in the prior-year comparative period (FY2022).

More importantly, for dividend investors, Singtel’s full-year dividend pay out rose 60% year-on-year to 14.9 Singapore cents per share.

However, investors should remember that there was a total special dividend per share of 5 Singapore cents, funded from capital recycling.

If we look at just its ordinary dividend, Singtel declared a FY2023 dividend per share (DPS) of 9.9 Singapore cents, up a much less impressive 6.4% year-on-year from the DPS of 9.3 Singapore cents for FY2022.

Furthermore, it’s paying out 80% of its underlying profit for FY2023 as ordinary dividends. That’s still a dividend payout ratio that’s too high for those of us looking for reliable long-term dividends.

Regional associates bounce back

There were some bright spots for Singtel, though. One was the bounce back in the profit generated from its various stakes in regional telcos.

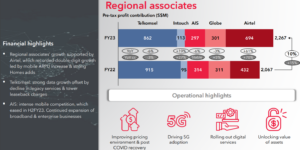

Overall, these regional associates generated S$2.26 billion in pre-tax profit, up 10% year-on-year (and up 15% year-on-year on a constant currency basis).

The biggest driver was its stake in India’s Airtel, which saw strong double-digit growth due to improved average revenue per user (ARPU) for mobile in the south Asian market.

Other highlights were Singtel’s stakes in Indonesia’s Telkomsel and Thailand’s AIS (see below).

Source: Singtel FY2023 earnings presentation

Still in a net debt position

Singtel’s earnings did improve in H2 FY2023, with underlying profit (for the six months ending 31 March 2023) hitting S$1.1 billion – up 11.5% year-on-year from the same period the year before.

Overall, earnings for Singtel came in slightly below expectations – which explains the cumulative drop of nearly 3% for Singtel shares since its earnings were released on Thursday morning (25 May).

Finally, while Singtel’s net debt position improved by S$2 billion in FY2023, it still has a sizeable net debt position of S$8 billion.

That makes one of Singtel’s investment cases – buying shares for the dividend – much less compelling.

With limited immediate avenues for growth, Singtel shares don’t look like they’re worth buying for either growth or income.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.