1 Big Industrials Stock to Buy Amid High Inflation

January 20, 2022

Long-term investors will always have to deal with inevitable bouts of volatility in the stock market. Right now, we’re experiencing one of those periods.

Clearly, that’s been down to expectations of higher interest rates from the US Federal Reserve (Fed) on the back of inflation in the US that has hit a 30-year high.

Yet, as I wrote about earlier this month, pricing power will matter when it comes to judging whether companies can pass on cost increases to customers.

In this sense, you’ll want to own companies that are operating in sectors with high barriers to entry but which still have robust competitive positions. That will give them the power to raise prices.

If you take the long-term view, the recent declines in stock markets allows long-term investors to own great businesses at a discount.

So, here’s one industrials stock that could prove to be a winning one to buy in an inflationary environment.

Old and Deere

Many investors may not have come across Deere & Company (NYSE: DE), which owns the famous John Deere brand, but it’s one of the oldest companies in the US – tracing its roots back to 1837.

That was the year its founder (John Deere) developed the first commercially-successful steel plough.

Today, Deere remains one of the world’s pre-eminent manufacturers of agricultural machinery, heavy equipment and various other construction-based equipment.

Clearly, the company has staying power and just because of its heritage, it doesn’t mean it’s not integrating technology into its business to keep up with the digital transformation sweeping across all sectors.

At the annual Consumer Electronics Show (CES) in Las Vegas last week, John Deere unveiled the first fully-autonomous tractor, allowing farmers to till their land remotely – saving farmers a huge chunk of time.

Big player in a growing market

John Deere is a big player in the agricultural market, which has continued to see technology play a more integral part in making operations more efficient.

According to Technavio, the global artificial intelligence (AI) market in the agriculture industry globally will grow at a compound annual growth rate (CAGR) of 22% from 2020-2024.

John Deere is set to take a large chunk of that growth as the company touches nearly every facet of rural and farm life.

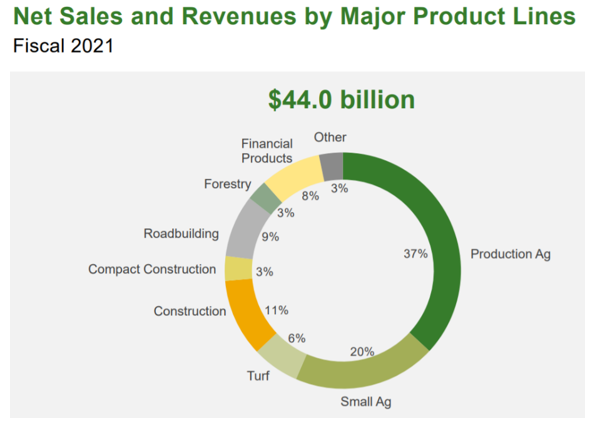

The best example of that is the firm’s latest fiscal 2021 revenue breakdown, which highlights what a diversified and comprehensive business it runs (see below).

Source: John Deere investor presentation, November 2021

Source: John Deere investor presentation, November 2021

Deere also has an enviable financial profile, having posted a record operating cash flow in fiscal 2021 of US$5.9 billion, up from around US$4.8 billion in fiscal 2020.

What’s more, the company is spending 5.3% of net revenues on R&D to stay ahead of the competition in its market.

Monitor the business

With inflation being seen across the economy in the US, investors should watch John Deere and its business to see if they end up passing the rising costs of manufacturing on to their customers.

With solid companies that have market-leading positions, they should be able to do this and if there’s one company that leads the way in agricultural machinery worldwide, it’s John Deere.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.