1 Growth Stock to Buy and Hold for Your Kids

January 24, 2022

When we think about investing for the long term, we want to ensure that we’re building wealth over years and not just months.

That’s even more applicable when we want to build wealth for our children. In that sense, it’s useful to get them interested in investing from a young age.

And what better way to get kids interested in investing than introducing them to the companies that they interact with every day?

This week the world will celebrate International Lego Day on 28 January. Those bits of plastic have been synonymous with building new and imaginative worlds.

Unfortunately for investors, Lego isn’t a listed company. However, one growth company that has been making waves with kids of all ages – by providing the building blocks of imaginary worlds in the digital realm – is Roblox Corporation (NYSE: RBLX).

Here’s why Roblox, which is down over 30% so far in 2022, could be a stock to buy and hold for your kids over the next decade or two.

Letting gamers build new worlds

It may come as a surprise to many investors but Roblox has actually been around as a company since 2004.

Less of an actual game and more of a platform, Roblox basically allows users to play games in worlds created by millions of individual developers – all using Roblox’s design tools.

Roblox states that its mission is to “bring the world together through play”. The company has certainly been successful in doing that so far.

Roblox went public via a direct listing on the New York Stock Exchange in March 2021, and its performance as a business since then has been impressive.

In its latest third-quarter earnings, Roblox saw revenue jump 102% year-on-year to US$509.3 million. It also saw its average daily active users (DAUs) hit 47.3 million, up 31% year-on-year.

Those latest numbers came on the back of a tough comparable quarter in the third quarter of 2020, when most of the world was under lockdown.

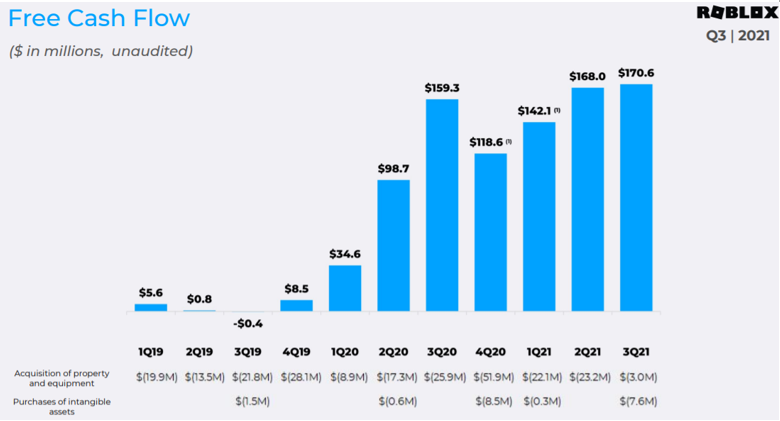

As a result, it’s a strong sign that the platform is continuing to be successful in its aim of engaging users. What’s more, in this high-growth sell-off, it’s interesting to note that Roblox is both operating cash flow positive and free cash flow positive (see below).

Source: Roblox Q3 2021 earnings presentation

Platform for users of all ages

While most of Roblox’s users were pre-teens (under the age of 13) before the Covid-19 pandemic hit, more than half of its users now are over the page of 13.

It sounds strikingly similar to Lego which, over the years, has grown its appeal to a much wider demographic than its core young following.

As more adults play and interact in Roblox worlds, the stickier the platform will become. In fact, while revenue growth has admittedly been slowing over the past few quarters, its hours engaged has been steadily increasing – reaching a whopping 11.2 billion in the third quarter.

In fact, according to Apptopia, Roblox was the second most-downloaded game globally in the whole of 2021 (across both the App Store and Google Play) with 182 million downloads.

One stock for the future

Having said all that, it’s important for investors to remember that interest rates are rising right now. As a result, money is flowing out of growth stocks and into value stocks.

Yet that doesn’t take away from Roblox’s business and what the management team is building for the long term.

It is worth being cognisant of the fact that Roblox remains loss-making on a GAAP net income basis as it continues to invest for future growth. That could see its share price being punished in the short term.

However, if you have a long-term time horizon and believe that Roblox could be the “Lego of the Metaverse” then buying a few shares of Roblox for your kids today could just inspire them on their long-term investing journey.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.