1 Hyper-Growth Stock Competing With Amazon and Microsoft

June 1, 2021

In the world of cloud computing, the two biggest players are undoubtedly Amazon.com Inc (NASDAQ: AMZN) and Microsoft Corporation (NASDAQ: MSFT).

With Amazon Web Services (AWS) and Microsoft Azure, the two tech giants have managed to capture a large share of the nascent cloud market.

In third place, there’s Google Cloud, run by parent Alphabet Inc (NASDAQ: GOOGL). However, more recently one company has threatened the incumbents by looking to disrupt their cloud businesses.

On cloud nine

That company, of course, is recently-listed Snowflake Inc (NYSE: SNOW). Having witnessed a lot of hullabaloo in the market around its IPO last year, Snowflake has appealed to clients with its “platform-agnostic” data warehousing solution.

The service Snowflake offers can work across the cloud, using either AWS, Azure or Google Cloud. Its data platform allows clients to better manage, store and analyse all its data in the cloud, with flexibility via a consumption-based business model (so not a subscription service).

Snowflake had already clearly caught the attention of big names given its growth story. Warren Buffett’s Berkshire Hathaway Inc (NYSE: BRK.B) as well as tech titan Salesforce.com Inc (NYSE: CRM) had invested sizeable sums in the company’s IPO.

How has it performed since then, though? On the share price side, it hasn’t been all that smooth. After initially doubling on the first day of trading, Snowflake shares are now trading around 5% below where they closed on the first day back in September 2020.

Yet the business appears to be doing well after Snowflake released its first-quarter FY 2022 results last week.

Growing at scale

Snowflake had an impressive quarter. For the three months ending 30 April 2021, the company managed to grow revenue at 110% year-on-year to US$228.9 million, ahead of consensus expectations.

Although its net loss widened to US$203.2 million, from US$93.6 million a year earlier, investors are more excited about its other growth metrics.

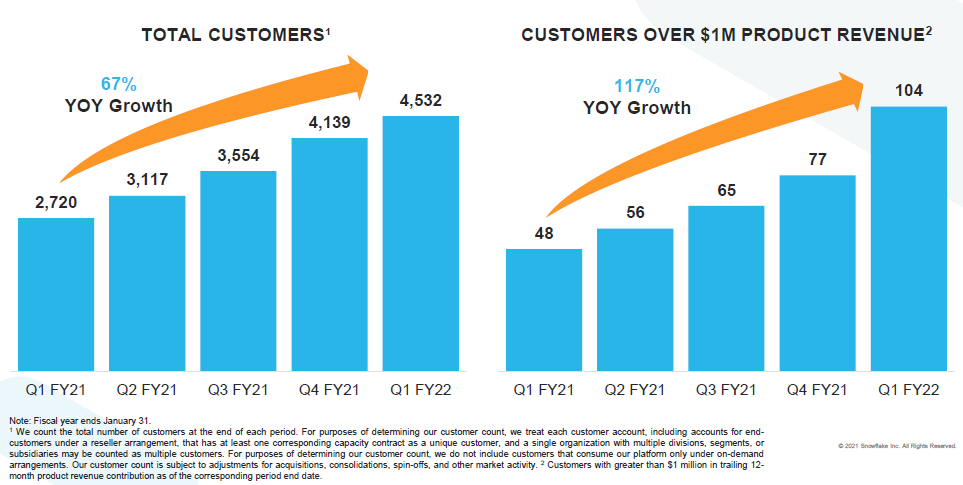

These include exceptional growth in the number of customers with over US$1 million in product revenue, which soared 117% year-on-year in the latest quarter (see below).

Source: Snowflake first-quarter FY 2022 earnings presentation

Not only that but Snowflake’s dollar-based net retention rate is an impressive 168% – when a lot of software firms view 120-130% as “strong”.

On its latest earnings call, management also talked about the implementation of storage compression, which should help widen already-strong gross margins of 72% in its latest quarter.

Can it keep growing?

One of the big questions for investors is how it can continue to provide an appealing service in the face of the “infrastructure” cloud giants of AWS, Azure and Google Cloud.

Relying to a certain extent on their services itself, Snowflake could find itself over-reliant on any one provider that it builds its products on.

Meanwhile, another huge cloud hangs over its valuation – with its forward 12-month price-to-sales (PS) ratio at an eye-watering 70x.

However, Snowflake finds itself well-placed to continue benefitting from the world’s “migration to the cloud”.

Disclaimer: ProsperUs Head of Content Tim Phillips doesn’t own shares of Microsoft Corporation.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.