Time to Buy Twilio Shares After 10% Gain?

October 2, 2020

Twilio Inc (NYSE: TWLO), a cloud communications platform as a service company, surged 9.7% in after-hours trading as the tech firm announced in a filing that its upcoming third-quarter results could be far better than expected.

Tim’s Take:

Ever received a text from Grab confirming your ride and charge to your credit card? Or perhaps an automated call confirming your appointment with a hospital specialist?

If so, it’s likely Twilio, or another platform as a service (PaaS) company, was behind the scenes making that happen.

Twilio effectively provides developers a bridge to communicate between the Internet and the telephony network.

Given the massive differences between the two, nearly all companies can easily outsource this function to cloud communications firms.

This has been a huge boon to Twilio. Despite investors initially thinking the company would be hit by the fall in revenue from key customers, such as ride-hailing app Lyft Inc (NASDAQ: LYFT), the company actually surprised with revenue numbers in both the first and second quarters.

Since hitting a low in March, Twilio shares are up over 300% in less than seven months. Despite the surge, the revenue growth figures have backed it up.

Customers love Twilio

In its latest quarter, Twilio notched up 46% year-on-year revenue growth to US$400.8 million and saw a dollar-based net expansion rate of 132%.

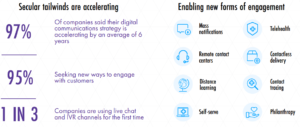

Meanwhile, active customer accounts were up 24% year-on-year to 200,000. The company’s opportunity set is fast-expanding as businesses start to focus more on the need to up their digital communications strategies in this “new normal” (see below).

Source: Twilio “Covid-19 Digital Engagement Report”, as of July 2020

Twilio is also expanding into new areas, with its latest announcement of the launch of Microvisor – an Internet of Things (IoT) connectivity and device management platform for developers.

I’m a big fan of the co-founder and CEO Jeff Lawson, who has consistently managed to stay ahead of the curve in the space.

Twilio estimates that its total addressable market (TAM) is at around US$66 billion, with its full-year 2019 revenue of US$1.13 billion meaning it has only 1.7% share of the market.

The runway for future growth is clearly huge. However, one thing investors should note is the firm’s profitability, or rather lack of it.

Twilio posted a GAAP loss from operations of US$102.6 million for the second quarter of 2020, an increase from the US$93.7 million loss it posted in the same period in 2019.

It has been consistently loss making since going public. But for long-term investors who are willing to look further out into the future and see what the new era of digital communications will look like, Twilio is likely to play a big part in it.

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares in Twilio Inc.

This material is categorised as non-independent for the purposes of CGS-CIMB Securities (Singapore) Pte. Ltd. and its affiliates (collectively “CGS-CIMB”) and therefore does not provide an impartial or objective assessment of the subject matter and does not constitute independent research. Consequently, this material has not been prepared in accordance with legal requirements designed to promote the independence of research. Therefore, this material is considered a marketing communication.

This material is general in nature and has been prepared for information purposes only. It is intended for circulation amongst CGS-CIMB’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this material. The information and opinions in this material are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, derivative contracts, related investments or other financial instruments or any derivative instrument, or any rights pertaining thereto. CGS-CIMB have not, and will not accept any obligation to check or ensure the adequacy, accuracy, completeness, reliability or fairness of any information and opinion contained in this material. CGS-CIMB shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.