It is not a secret that the Singapore stock market has a lot of emphasis on REITs and banks.

Many even look at the Singapore stock market as a proxy for dividend or income play.

However, if you’re looking for a growth stock in Singapore, I believe Singapore Telecommunications Limited (SGX: Z74) fits into your portfolio.

In fact, with a dividend yield of 3.6%, Singtel also has a stable dividend payout from its quality communications business.

These are the three growth trends that Singtel plans to ride on.

1. The 5G leader in the region

Singtel is the largest telecommunications operator in ASEAN (Association of Southeast Asian Nations)by market capitalisation and the company is likely to leverage on its size to increase its market share as the region shifts to 5G.

Currently, Singtel is the largest mobile network operator in Singapore and has expanded aggressively outside its home market and owns shares in many regional operators including full ownership of Australia’s second largest telco, Optus as well as a 31.7% stake in Bharti Airtel, the second largest carrier in India.

Recently, Singtel has been appointed by Micron Technology to deploy its 5G milimetre wave (mmWave) solutions with localized edge core at the semiconductor manufacturer’s 3D NAND flash memory fabrication plant in Singapore.

This deployment is the first of its kind and could help accelerate the push for industry 4.0 manufacturing applications.

This rollout follows successful trials using Singtel’s GENIE, the world’s first portable 5G-in-a-box platform, which helped to validate the mmWave solution, verify its performance and demonstrate the operational benefits of Singtel’s 5G solutions in Micron’s next generation cleanroom.

While the rollout of 5G will see incremental capital expenditure, Singtel has strong cash flow generation due to earnings recovery as well as capital recycling.

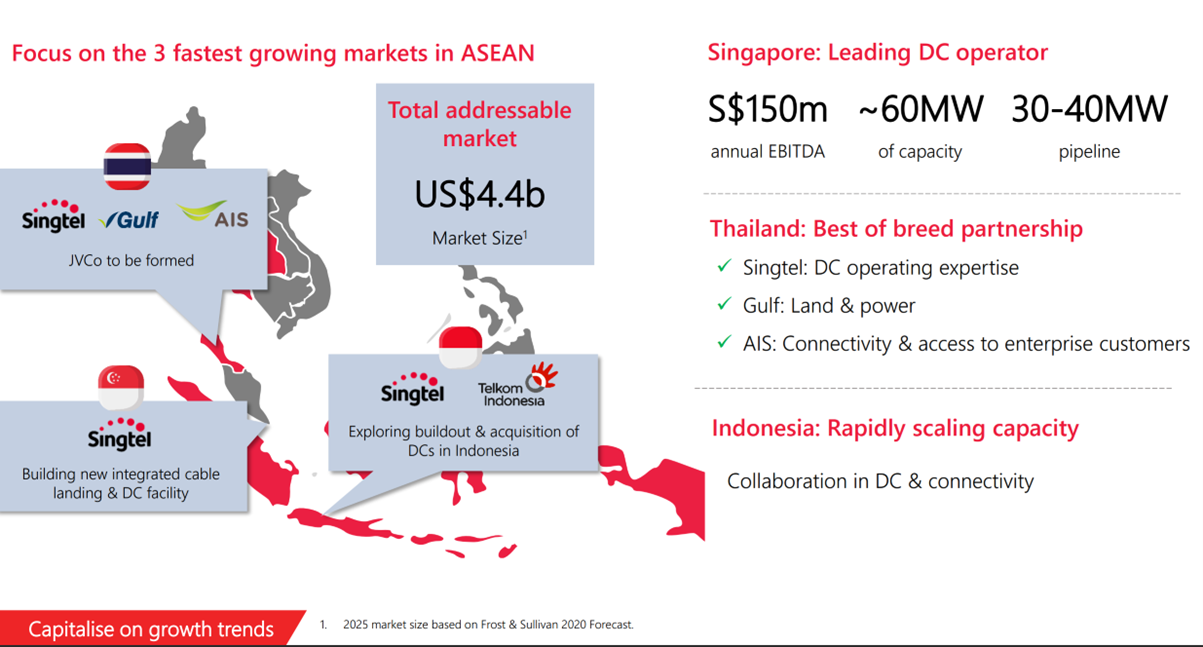

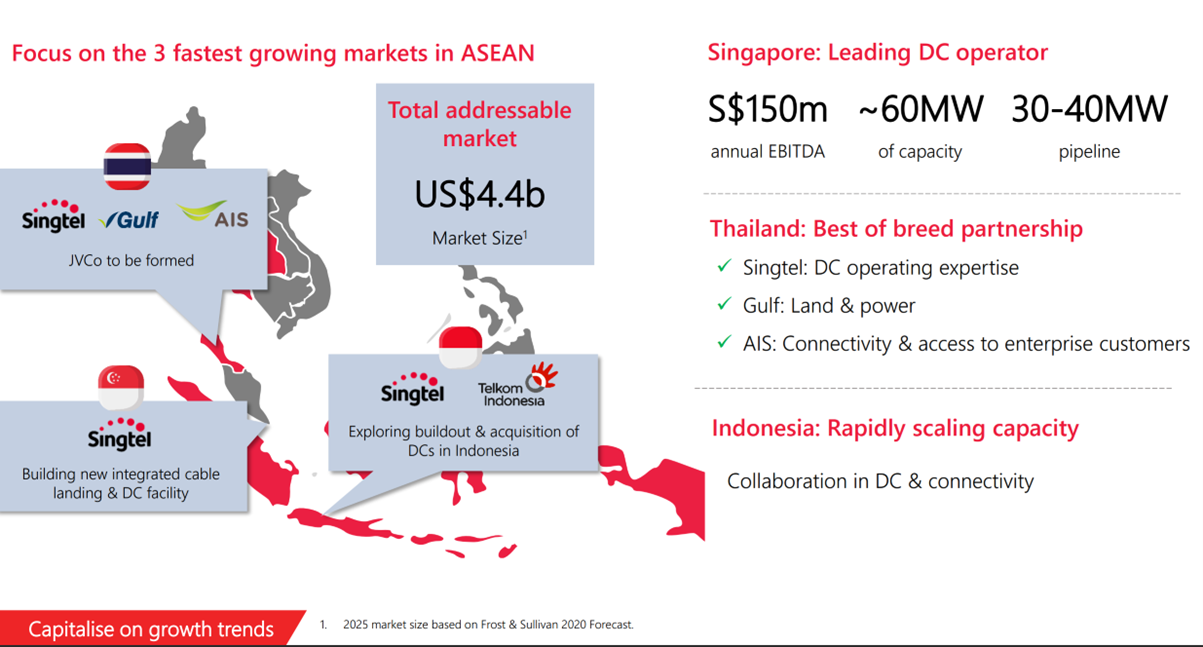

2. Capture sizable opportunity in data centre in ASEAN region

Singtel continues with its asset recycling initiatives to reinvest net proceeds from divestments into its core business including 5G rollouts, regional data centres and digital banking.

In its FY2022 earnings, revenue in its group enterprise moderated lower due to lower revenue from its carriage segment but ICT revenue jumped by 5% led by strong data centre demand.

Looking ahead, Singtel will build new data centre capacity to tap on the strong demand.

Source: Singtel’s Investor Presentation for financial results during FY2022

Source: Singtel’s Investor Presentation for financial results during FY2022

3. Digital banking

The digital banking space also offers another positive development for Singtel.

A consortium consisting of GXS Bank (Grab-Singtel’s 60:40 JV) and Malaysian investors including the Kuok Brothers Sdn Bhd, have secured one of a total of 5 digital banking licenses issued by the Bank Negara Malaysia (BNM).

GXS has a 55.45% stake in the consortium, which means that Singtel’s effective stake is at 22%.

Over the next two years, the proposed digital bank will undergo a period of operational readiness before commencement of operations.

Source: Singtel’s Investor Presentation for financial results during FY2022

Source: Singtel’s Investor Presentation for financial results during FY2022

With the win in Malaysia, GXS has digital banking licenses in Singapore, Indonesia and Malaysia.

The strong partnership formed also puts Singtel in a good position to grow and build scale in this area.

Singtel is more than a telco company

While Singtel’s telco business continue to remain as its core business in the near future, the expansion into data centres and digital banking will put the telco giant on a strong growth trajectory.

I also like the partnership that Singtel has embarked on as it helps to accelerate the process to build scale in its new business.

It is still too early to tell but I think long-term investors should buy into Singtel for its growth story more than its stable dividends.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Source: Singtel’s Investor Presentation for financial results during FY2022

Source: Singtel’s Investor Presentation for financial results during FY2022 Source: Singtel’s Investor Presentation for financial results during FY2022

Source: Singtel’s Investor Presentation for financial results during FY2022