3 Top Cybersecurity Stocks Singapore Investors Can Buy and Hold

August 22, 2023

In Singapore, investors may have to look overseas for large technology stocks that are tapping into structural growth trends.

One of these global trends – that will only accelerate further in the decade ahead – is cybersecurity. That’s mainly because there’s a huge growth runway for the industry.

According to a 2022 survey by McKinsey, there’s only a 10% penetration globally for security solutions today.

That means the total addressable market (TAM) for cybersecurity is in the region of US$1.5-2 trillion, 10 times its current size of US$150 billion.

So, how should investors approach this exciting, but highly technical, growth opportunity? It’s worth buying a “basket” of stocks that could be potential winners in the space.

For Singapore investors looking for some growth exposure to the cybersecurity market, here are three quality stocks operating in the sector that they can buy and hold for the long term.

1. Zscaler

First up is Zscaler Inc (NASDAQ: ZS), a zero trust cybersecurity platform that was founded in 2007.

As the cloud computing industry has matured and evolved, so has cybersecurity in the realm of the cloud.

Zscaler runs a leading network security ecosystem that helps to operate one of the largest security cloud platforms in the world. Essentially, Zscaler believes that “zero trust” is needed to defend enterprise users in the cloud.

By having a cloud-centric security solution for enterprises, Zscaler has been able to scale its security architecture more effectively.

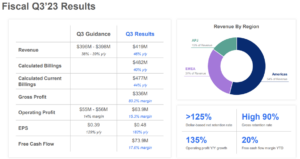

With over US$1.5 billion in annual recurring revenue (ARR) and revenue growth of 46% year-on-year (to US$419 million) in its most recent quarter, Zscaler is a growing business.

As with similar growth stocks, a focus on more operating efficiency has resulted in operating profit and free cash flow improving.

Indeed, in its most recent Q3 FY2023 period (for the three months ended 30 April 2023), Zscaler saw operating profit of US$63.9 million, up 135% year-on-year (see below).

Source: Zscaler Q3 FY2023 earnings presentation

With continued growth and a higher free cash flow margin, Zscaler is one of the leading candidates for Singapore investors in the cybersecurity space.

2. Palo Alto Networks

For investors looking at a larger player in the cybersecurity industry, then Palo Alto Networks Inc (NASDAQ: PANW) could be the answer.

The firm has been around since 2005 and initially listed on the Nasdaq exchange in 2012. Both the stock’s five-year and 10-year returns have easily outpaced the S&P 500 Index.

That’s because Palo Alto Networks has grown into a comprehensive cybersecurity behometh with around US$6.9 billion of revenue in its latest FY2023 (for its fiscal year ended 31 July 2023).

That figure was up 35% year-on-year from FY2022 and came in at the top end of management’s FY2023 guidance.

With a “platformization” approach, Palo Alto Networks is looking to tap into large corporates and serve the enterprise security market more fully.

As part of its goal, it wants to make recurring revenue a larger part of its business. Over the past three years, management has succeeded in that aim as recurring revenue now made up 79% of overall sales in its latest quarter versus 68% in Q4 2020.

Guidance from management for 19% year-on-year revenue growth (at the top end) for FY2024 means that overall sales will come in at US$8.2 billion.

3. Crowdstrike

Finally, we have one of the most recognisable names in the cybersecurity industry in recent years – Crowdstrike Holdings Inc (NASDAQ: CRWD).

The current focus of the company on the “security cloud” for endpoint users (basically devices like smartphones) is spearheaded by its cloud native, AI-powered Falcon platform.

By utilizing AI and machine learning (ML), Crowdstrike’s security cloud looks to learn from thwarted attacks to better protect users in the future.

Crowdstrike’s financial performance has also been solid with its subscription ARR at US$2.73 billion as of its latest quarter (Q1 FY2024).

With strong gross margin of 80% for its subscription business, Crowdstrike has been able to grow its free cash flow to US$227 million in its latest quarter, up 44% year-on-year.

As the company looks to continue to grow among large corporates, it’s likely to maintain its position as a leading provider of cybersecurity services.

Buying the market leaders in cybersecurity

In any structural theme that is also technical, and where the big winners may not be immediately obvious, it’s important for investors to focus on taking a basket approach to stocks.

With Zscaler, Palo Alto Networks, and Crowdstrike, Singapore investors will have comprehensive exposure to three leading global cybersecurity companies now and in the future.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares of Crowdstrike Holdings Inc.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.