5 Top Stocks to Buy in March

March 2, 2022

The Russian invasion of Ukraine will add to the hurdles faced by investors as it is likely to keep inflationary pressure high while also posing downside risks to global economic recovery.

Investors already had their hands full even before the invasion with multiple risk factors to look at – high inflation, the reversal of the stimulus packages seen during the last two years, the anticipated US Federal Reserve (Fed) rate hike, the US-China trade conflict and other market uncertainties.

While geopolitical tensions rarely change the underlying fundamentals in stock markets (unless the event significantly alters the paradigm of our economy), these events tend to have a severe impact on the stock market trend, at least in the near term.

By taking into consideration the near-term volatility, long-term growth potential, diversity in the selection, I have identified five top stocks to buy in March.

Furthermore, investors can also create a portfolio based on this selection for under S$1,000.

1) P&G

Procter & Gamble Co (NYSE: PG) needs no introduction as it owns some of the best and well-known household products.

I also like the company for its diversification in various markets. This allows the company to be less vulnerable to weakness in any single market.

While there is concern that rising inflation will hurt margins for P&G, the company has a gross margin of 49.4%, which is higher than the sector median of 34%.

Aside from that, earnings growth has been stable with organic growth at around 6%. With its stable earnings, P&G also provides a stable return to shareholders via a dividend.

At its current price of US$153.31, it offers a dividend yield of around 2.2%. This is based on a payout ratio of around 60%, which offers investors dividend safety.

Over the last decade, the company’s dividend has grown at a compound annual growth rate (CAGR) of 5.1%.

If there is a rotation from growth to value stocks, I believe P&G will be one of the beneficiaries of this theme.

2) Microsoft

If you are looking for a company that offers both dividend safety and growth potential, Microsoft Corporation (NASDAQ: MSFT) should be top of that list.

With 21% global market share of the enterprise cloud market, Microsoft is the second-largest enterprise cloud provider, behind Amazon.com Inc’s (NASDAQ: AMZN) AWS.

Aside from cloud services, Microsoft also has exposure to the development of the Metaverse (via its Hololens), the gaming industry and personal computing.

As seen during the COVID-19 pandemic, the company’s diversified earnings stream and business model has managed to drive stable earnings growth despite the impact on large companies that rely on Microsoft’s legacy software.

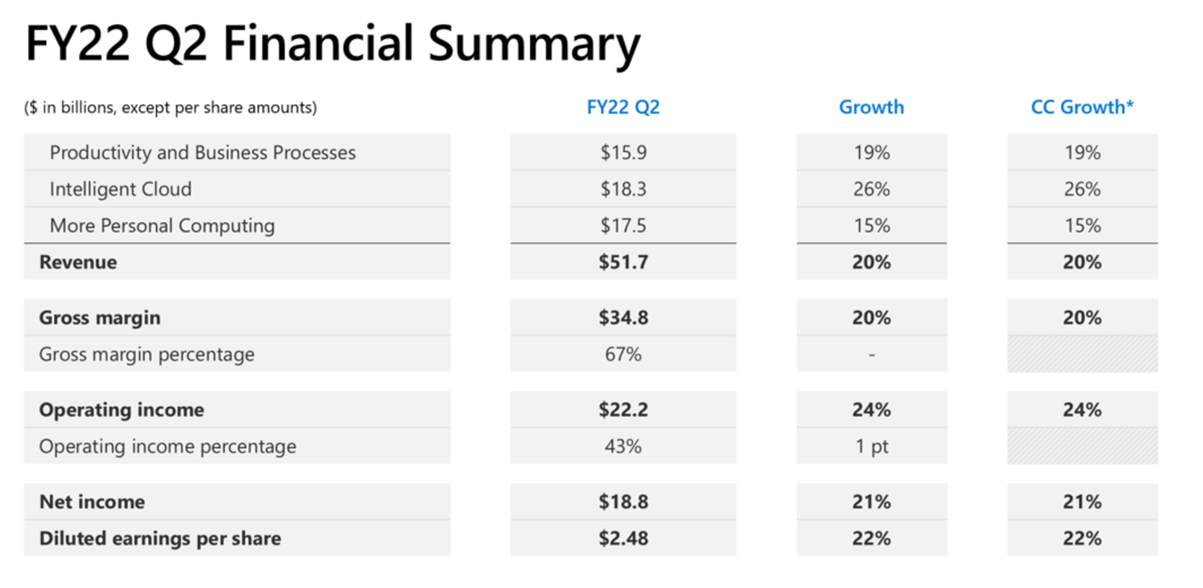

In fact, during the company’s second quarter of its financial year 2022 (Q2 FY2022), Microsoft posted 20% revenue growth, supported by growth across all its business segments (see below).

The company also has a strong margin of around 34.8%, which will come into play with rising inflation.

Source: Microsoft Q2 FY2022 earnings presentation

Source: Microsoft Q2 FY2022 earnings presentation

In terms of dividends, Microsoft also has a dividend yield of around 0.8%. While this is only modest as compared to other dividend plays, it is worth noting that Microsoft has a dividend CAGR of 12.6% over the last decade with only 28% of its cash flow spent on the payout.

At its current price of US$294.95, it is not cheap with a trailing price-to-earnings (PE) ratio of 32 times.

But given that it has fallen by 15.6% from its one-year high of US$349.67, I think this offers a good opportunity to buy into a company with a strong track record, history and growth potential.

3) Crowdstrike

I have previously talked about “2 Defense Stocks to Buy as Geopolitical Tensions Simmer” in the middle of last month

While I think defense contractors such as Lockheed Martin Corp (NYSE: LMT) and Northrop Grumman Corporation (NYSE: NOC) could remain beneficiaries from the Russia-Ukraine conflict, the surge in prices in such a short time made them look too pricey to be included in the top buys for March.

Instead, I’ll go with one of the leading cybersecurity cloud operators, Crowdstrike Holdings Inc (NASDAQ: CRWD).

Investors will be interested to know that Russia was considered one of the leaders in state-sponsored cyberattacks against the US last year.

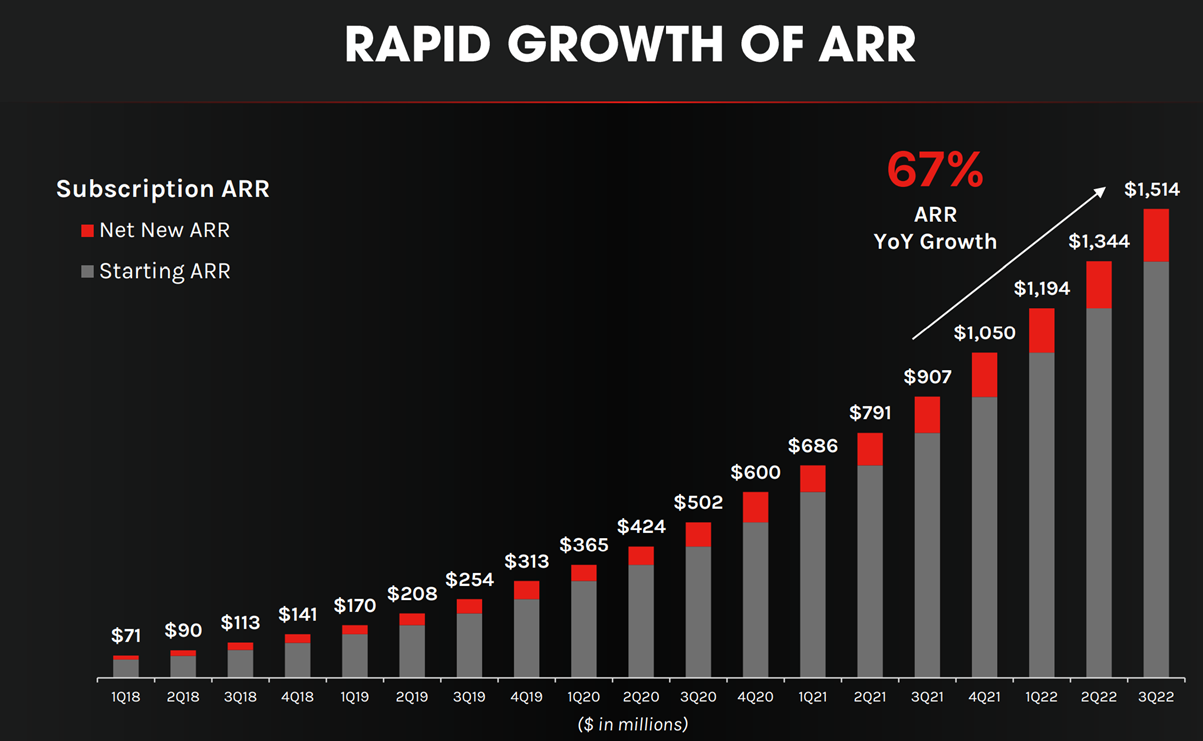

Aside from these positive tailwinds, Crowdstrike has continued its rapid growth as its annual recurring revenue (ARR) increased by 67% year-on-year to US$1.5 billion during the third quarter of its financial year 2022 (Q3 FY2022).

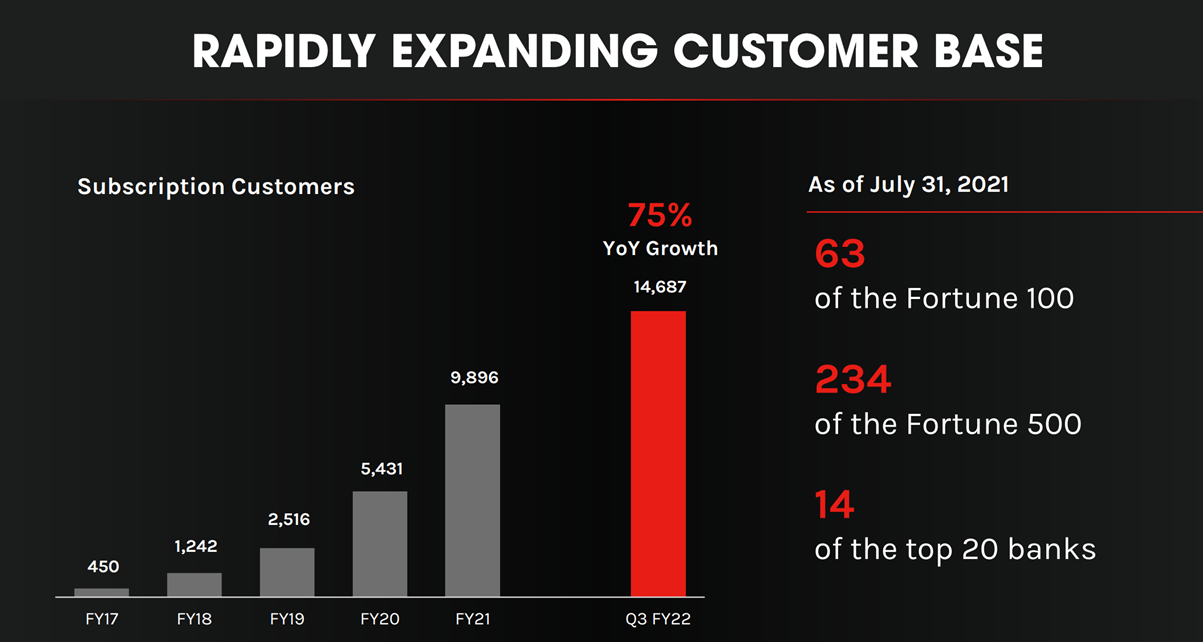

The subscription business model that Crowdstrike has also makes it attractive – as seen by the 75% year-on-year increase in the number of its subscription customers in Q3 FY2022.

At US$197.64, Crowdstrike shares are not cheap with a trailing PE ratio of 334.97 times.

Having said that, I think it fits into the portfolio as a growth stock, as well as to capture the rising trend in the near term.

Source: Crowdstrike Q3 FY2022 earnings presentation

Source: Crowdstrike Q3 FY2022 earnings presentation

Source: Crowdstrike Q3 FY2022 earnings presentation

Source: Crowdstrike Q3 FY2022 earnings presentation

4) NortonLifeLock

NortonLifeLock Inc. (NASDAQ: NLOK) provides consumers with cybersecurity solutions. The company focuses on three areas: security, identity and privacy.

Its product, Norton 360 offers a comprehensive and easy-to-use platform for consumers to prevent, detect and restore potential threats and damage done by cybercrimes.

The company’s recent acquisition of Avast will also support sales going forward. With Avast’s 435 million-strong customer base and its focus on small- and mid-size businesses, the acquisition will provide the synergy necessary for NortonLifeLock.

Given the rising awareness of cyber threats and the importance of privacy among consumers, I expect to see this benefit NortonLifeLock in the long term.

As it is, the company has delivered a growth of 10% year-on-year in its third quarter results for FY2022.

NortonLifeLock is trading at a trailing PE of 17.2 times at its current share price of US$28.86, which is lower than the 20 times that its peers trade at.

5) GoPro

I think if investors are looking for the best stock pick below US$10, GoPro, Inc. (NASDAQ: GPRO) is a top contender.

GoPro is a manufacturer of action cameras and developer of mobile apps and video editing and sharing software.

While the company has struggled to expand its growth since 2010, there is a shift in its business model, and I think there is an opportunity for a breakthrough going forward.

The company has introduced subscription packages and services recently with the ability to create an ecosystem for its clients.

These services include cloud storage, editing capabilities and other offerings such as discounts, equipment protection services and other offers for its hardware equipment.

Since the introduction of these services, the direct-to-consumer (DTC) subscription service has enabled some strong revenue sources to be created.

Subscription revenue only accounted for 5% of its total revenue in financial year 2021 (FY2021), at US$53 million, but it represents an increase of 131% year-on-year.

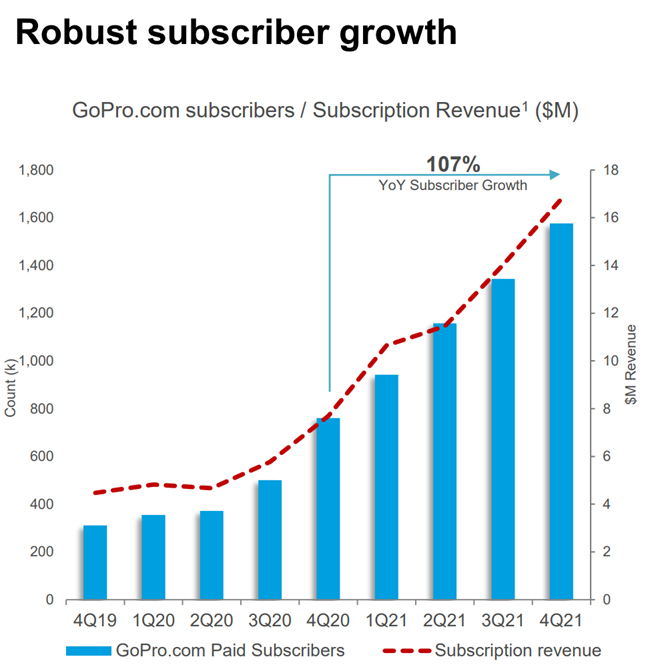

GoPro.com subscribers increased by 107% year-on-year to 1.6 million in 2021 while its Quik mobile app subscribers grew to around 221,000.

Its strong large cash stockpile and low levels of debt will also allow it to navigate through the rising interest rate environment.

At US$8.36, GoPro is trading at a trailing PE of only 9 times and with more people returning to outdoor activities, I believe the “Apple” of the action camera world deserves to be one of my top picks this month.

Source: Investor Presentation (February 2022)

Source: Investor Presentation (February 2022)

Stay invested with a diversified portfolio

It is hard to stay rational and invest during a volatile market but there is an opportunity in every market. The key is to diversify your portfolio.

With P&G, Microsoft, Crowdstrike, NortonLifeLock and GoPro, investors have five ideas that could create a diversified portfolio for under S$1,000.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.